Our online business establishment portal enables you to form a limited company electronically 24/7 in the UK, including England, Wales, Scotland and Northern Ireland.

It is quick and easy to get started, with a fast turnaround and low cost:

Electronic filing.

Online registration involves electronically filing the required documents with Companies House, the official Registrar of Companies in the UK.24/7 incorporation availability.

Online company registration is available around the clock, 24/7, allowing for flexibility in when you register an online business in the United Kingdom.Incorporation speed and efficiency.

Online formation services are significantly faster than traditional incorporation methods, which require filling out paper forms like the Form IN01.Convenience formation process.

You can set up your company from anywhere, at any time, as long as you have an internet connection and a computer or mobile device.The online formation process makes it a cost-effective option.

Online company formations can be more affordable and much faster than using traditional incorporation methods, especially when compared to paper-based forms.No paperwork or physical signature required.

Most certified and licensed service providers do not require physical paperwork or signatures for forming or incorporating a new company anywhere in the UK jurisdiction.

To establish a basic limited company in the UK, we must register it with Companies House, the official Registrar of Companies in the UK.

The process of forming a new limited company is straightforward. It requires personal information such as the full name, contact details, and official address of the company. Additionally, the application must include a registered office address, along with the appointment of at least one director and a stakeholder who holds at least one share.

Basic business formation package includes:

All government (Companies House) filing fee.

State fees required for forming a new private limited by a stock share company included in our price.Free business name check and clearance.

We make sure your company name is available to be filed in the Companies House in England and wales, Scotland or in Northern Ireland.24-hour electronic filing service.

Your new company is filed with the Companies House within 24 hours.Preparation of filing documents.

We take care of everything that’s need to prepare and get filed your Certificate of Incorporation.All essential corporate documents.

Your company documents delivered to you by email as soon as your new company is incorporated.Digital copy of your Certificate of Incorporation.

You will receive the digital copy of a Certificate of Incorporation by email.Model articles of association.

With the basic company startup plan, we sill submit your company for incorporation with the model articles of association and memorandum as well.WebFiling Authorization Code (Key).

The WebFiling Authentication Code, often called a company authentication code or PIN, is a 6-character alphanumeric code issued by Companies House to UK limited companies.Lifetime customer support.

Free online and telephone support for the whole life of your business entity.Free business banking account.

Free business bank account based on your choice.Free business business registration for Corporation Tax.

While the initial registration of a limited company with Companies House involves a fee, registering for Corporation Tax itself is typically free.Free business UTR number.

The Unique Taxpayer Reference UTR number is a unique 10-digit identifier assigned by HMRC to every newly established limited company.

What information and documents are required for a new company formations?

Our rapid application process requires only essential personal information, including your full name, contact details and the official address of your business. To ensure compliance, you’ll need to provide an official office address and appoint a director along with a stakeholder who holds at least one share. Simplify your business setup and take the first step towards success with our efficient service!

Face the Challenges of a company formation. Your business solution: our seamless incorporation service.

Setting up a company online (Electronically

) is generally faster, cheaper and more convenient than doing it by post:

Feature |

Online Business Incorporation |

Business Incorporation by Post |

|---|---|---|

| Incorporation Filing Cost | £100 (Companies House filing fess). | £71 (Registrar of Companies filing fees). |

| Our Setup Filing Cost | £4.99 (+ £100 Companies House filing fess). | £51 (+ £71 Registrar of Companies filing fees). |

| Time by Companies House | Usually in 24-48 hours. | Usually in 8-10 days. |

| Time by Coddan CPM | Usually in 1-6 business hours. | Normally in 8-10 days. |

| Convenience | Easier and more accessible. | Requires filing out paper forms and mailing them to Companies House office. |

| Support | Often includes online resources and professional support. | Always require extra and additional research and more deep support service. |

| Same-day incorporation | Additional fee applies for a same-day guaranteed incorporation service. | Extra higher fee applies for a same-day guaranteed formation service. |

| Paperwork filing | Minimal documentation is typically handled electronically through online processes. | It is necessary to fill out and send a paper form (IN01) via postal mail to the registrar at Companies House. |

| Speed | Faster, potentially same-day if submitted early. | Significantly slower, resulting in an extended waiting period for the approval of applications and accompanying documentation. |

| Complexity | Typically more straightforward, with reduced likelihood of rejection. | A more intricate filing procedure, accompanied by an increased likelihood of rejection stemming from mistakes. |

| Additional filing fees | 24-hour for the standard business registration process. Extra filing fee applies for the fast-track guaranteed same-day service. | 8-10 business days timeframe for the standard business registration process. There is no same-day filing service at Companies House. |

| Digital version of documents | Obtain digital and electronic versions of documents, and request a printed copy if necessary. | Post office delivery of physical copies of corporate documents. |

| Access to resources | Offers access to online resources and support from professional team. | Provides access to online resources and assistance from a professional team. |

| Security | Online incorporation generally uses secure digital platforms, ensuring data protection. | Mail services may present an increased risk of document loss or delays in delivery. |

| Payment | Enables online transactions through multiple payment options, including credit cards, debit cards, and PayPal, among others. | Require payment done by cheque or postal order. |

| Tracking | Provides online tracking of the application form status. | May require contacting Companies House for updates over the phone only. |

Fundamental aspects of establishing basic limited companies. Frequently Asked Questions.

What constitutes the formation of a basic limited company?

Starting a business involves incorporating it as a limited liability company, which means it becomes a separate legal entity from its owners. To begin, you must register with Companies House, comply with specific legal requirements, and prepare important documents such as a Memorandum and Articles of Association. In short, the process of forming a business includes establishing a legal business structure, officially registering it, and completing the necessary legal steps to operate as a limited liability company.

What are the essential components of a fundamental company registration?

In straightforward terms, the formation of a company refers to the legal procedure of establishing a new business entity. By incorporating, a business is recognized as a separate legal entity distinct from its owners, enabling it to operate independently. Consequently, this new entity is required to adhere to specific laws and regulations that provide a degree of protection for its owners.

A company represents a category of business wherein the entity is legally distinct, possessing rights akin to those of an individual, allowing it to incur debt, initiate lawsuits, and be subject to legal action. Unlike sole proprietorship or partnerships, members are not personally liable for the company’s debts.

What constitutes a private limited company with share capital?

A corporation is a type of business organization that operates as a separate legal entity. This means that the corporation has the same legal rights as an individual, allowing it to incur debts, sue, and be subject to legal action. Unlike sole proprietorships or partnerships, members of a corporation are not personally liable for its debts; their financial liability is limited to the amounts unpaid on their shares, if required.

However, directors of the corporation may face personal liability if they fail to fulfill their legal obligations. Forming a corporation can be expensive and complex, making it best suited to individuals whose business income may fluctuate significantly and who wish to use potential losses to offset future profits.

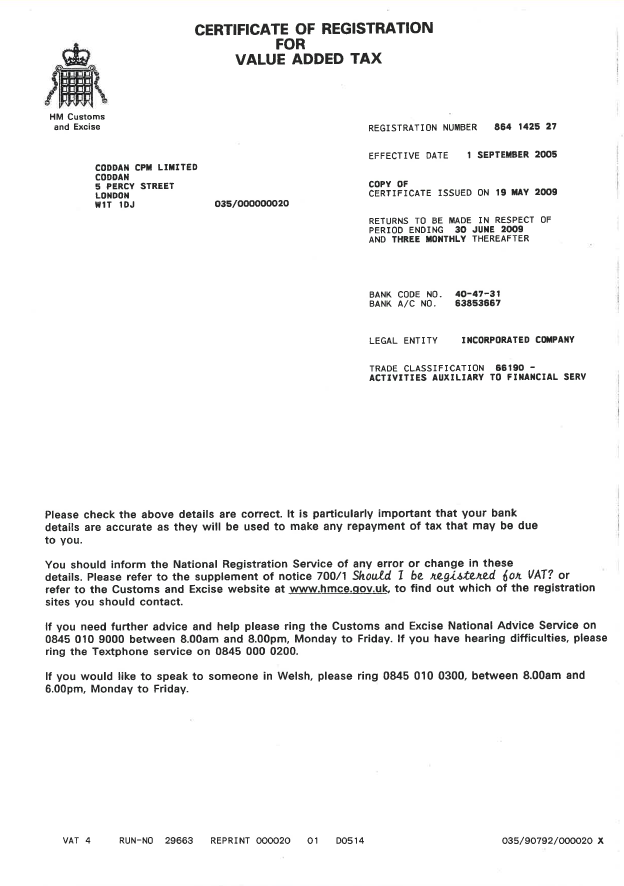

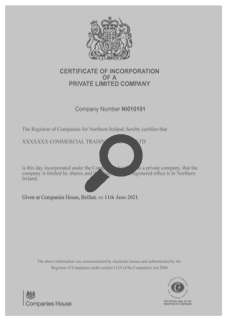

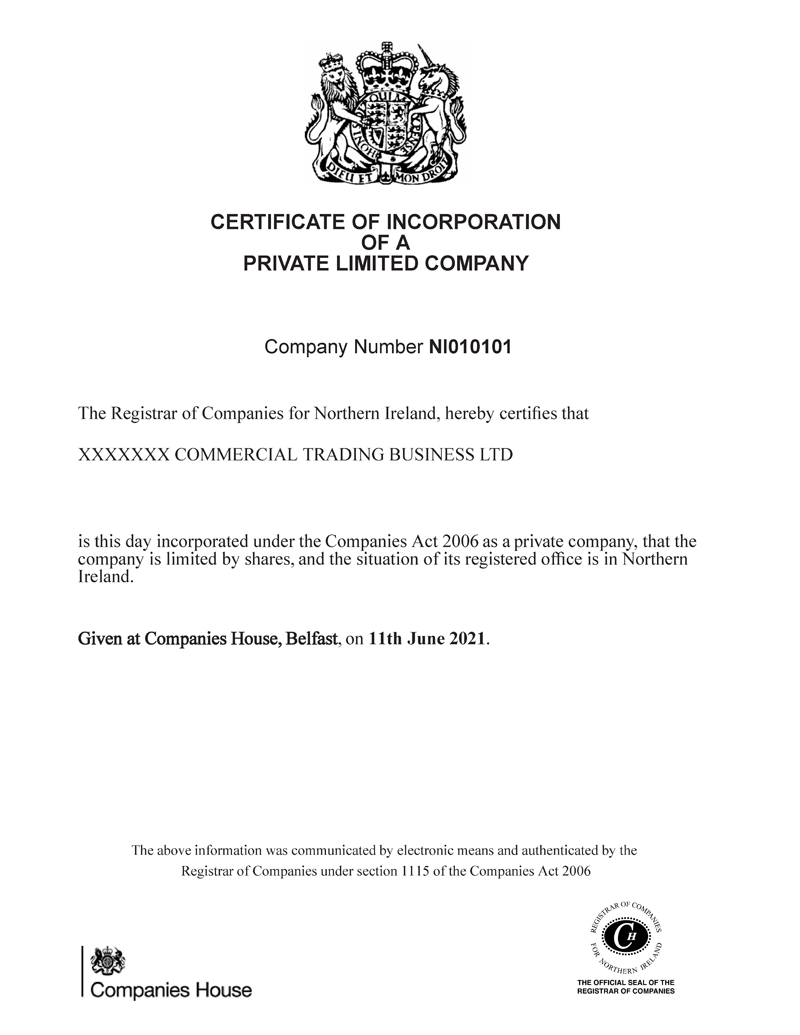

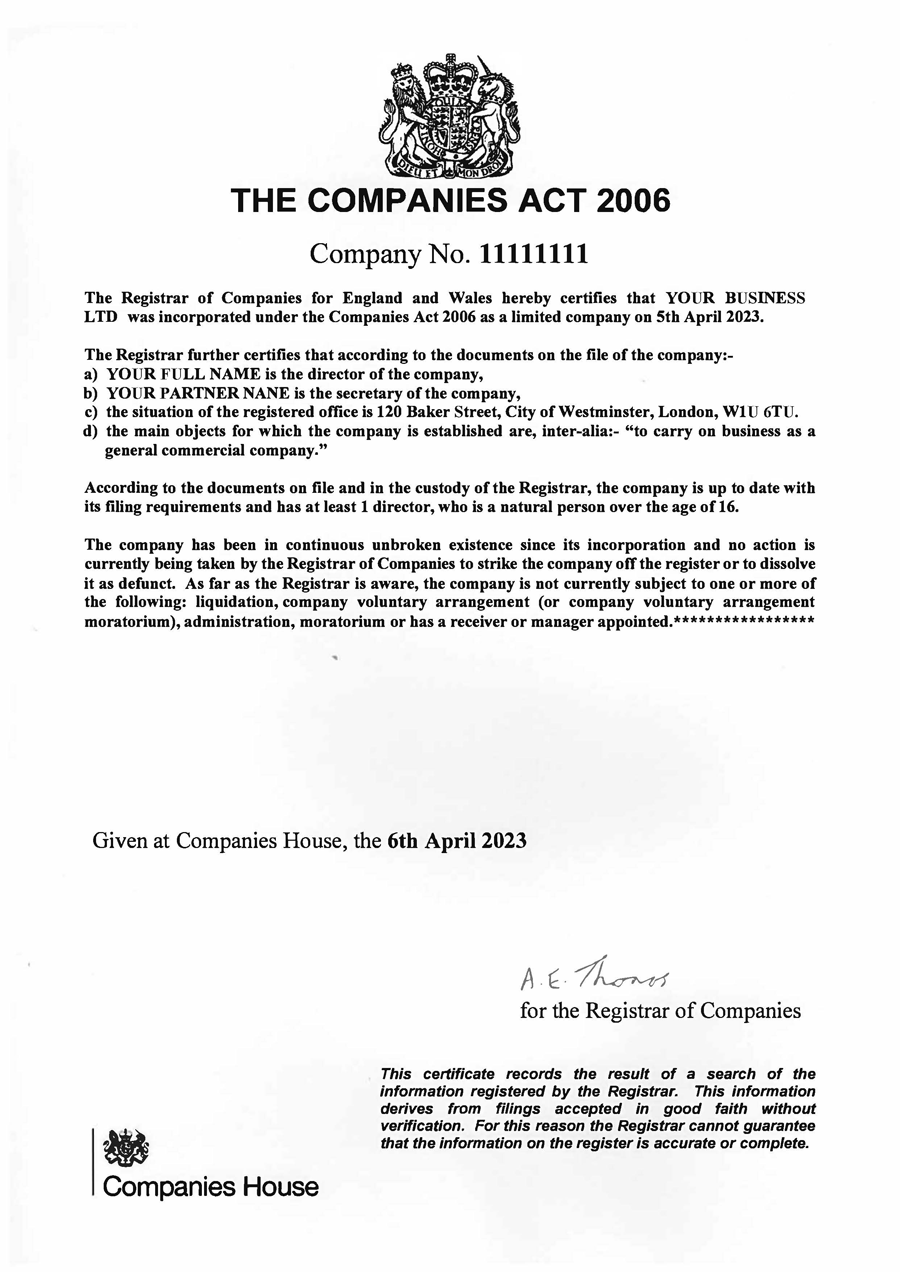

Is a certificate of incorporation included with every basic company incorporation?

When a company is incorporated, it becomes a separate legal entity, distinct from its shareholders or guarantors. The company’s details are recorded in the public register maintained by Companies House, which is accessible online. Companies House issues a Certificate of Incorporation that contains essential information, including the company’s registered name, date of incorporation, and company registration number (CRN).

This certificate serves as proof of the company’s existence and compliance with the Companies Act 2006. It is necessary for various purposes such as opening a business bank account, applying for loans or grants, and establishing business accounts. The registration process with Companies House requires a fee of £100, which can be paid by debit or credit card. Typically, the Certificate of Incorporation is issued within 24 hours, officially recognizing the company as a limited company or limited liability partnership. Additionally, registration for corporate tax is completed simultaneously with the company registration.

Is the fundamental process of establishing a company comprised of registering a new business with Companies House?

To set up a limited company in the UK, an application must be filed with Companies House using Form IN01. There are three primary methods for this process. The first option is to incorporate online through an authorized company formation agent, which utilizes electronic software for a quicker and more efficient experience. This method accommodates all company types, including those with custom articles and various share classes.

The second option is to use the web incorporation service available on the Companies House website, which allows for the formation of a basic private company limited by shares using Model articles of association and 'Ordinary' shares. The third method involves traditional paper filing by post, where the IN01 form can be downloaded and mailed to Companies House.

This approach is more time-consuming and potentially more expensive, as the paper application is lengthy, consisting of 35 pages, making it more complex than the online process. It is essential to ensure that the business operates legally to avoid fines. The guide will also discuss the advantages and disadvantages of different company types and provide tips for successful registration within these frameworks.

Should I establish and register a fundamental company to initiate an online business?

Company incorporation is the process of officially establishing a business as a limited company, creating a separate legal entity distinct from its owners. This legal status allows the company to have its own finances, liabilities, and property ownership. To complete the incorporation, it is necessary to register with Companies House and obtain a unique company registration number (CRN). This registration is crucial for the formal recognition and operation of the business within the legal framework.

What constitutes a fundamental company formation package?

A basic company formation package provides essential services and documents necessary for establishing a limited company. Key components typically include digital copies of the Certificate of Incorporation and the Memorandum and Articles of Association. These packages are particularly suitable for straightforward company setups and often feature online registration through Companies House, digital document delivery, and assistance with the application process.

This option is ideal for individuals on a tight budget who wish to form a company without the need for additional corporate documents. By opting for this package, users will receive a UK private company limited by shares, along with a complete set of digital company documents delivered directly to their email.

What are the advantages of selecting the basic limited company formation package?

This package is designed for individuals operating on a constrained budget who wish to establish a UK private company limited by shares at minimal cost. It includes the formation of the company and provides a complete set of digital company documents delivered via email. The package features online registration with Companies House, ensuring that all necessary documents are provided electronically in PDF format.

This option is particularly suitable for those looking to create a limited company without additional features or the need to reserve a company name. It covers all essential requirements for the company to begin trading.

The incorporation process includes a £100 filing fee, which is included in the package and managed on behalf of the client. Additionally, the Online Client Portal allows users to manage their existing companies and incorporate new ones efficiently, eliminating the need to re-enter information.

Competitive pricing and value for money in the formation of outstanding companies

The company formation service is competitively priced at £104.99, positioning itself as one of the best options in the UK corporate business market. The package includes essential components necessary for a company to begin trading, excluding the provision of an official address. Notably, major UK banks do not require physical copies of incorporation certificates or other documents for companies with a single shareholder or director; they verify details directly with Companies House to facilitate the registration and opening of a bank account.

Clients benefit from complimentary access to an administration portal, which simplifies the process of updating statutory records at Companies House. Furthermore, the service includes free support for the portal throughout the entire duration of the company’s existence, ensuring ongoing assistance for clients.

Is it possible to establish a limited company in the UK online at a low cost?

Establishing a limited company in the UK online is indeed possible and can be done at a low cost. The process typically involves registering the company with Companies House, which can be completed through their online service. This method is efficient and often more affordable than traditional registration methods. Key insights include the requirement for a unique company name, the appointment of at least one director, and the provision of a registered office address. Additionally, it is essential to prepare a memorandum and articles of association, which outline the company’s structure and rules.

Notable findings indicate that various online service providers offer packages that simplify the registration process, often including additional services such as business bank account setup and compliance support. Overall, the online registration process is designed to be user-friendly, making it accessible for entrepreneurs looking to establish a limited company in the UK with minimal financial investment.

What is the Web-Based Incorporation

Service?

The Web-Based Incorporation service provides a secure platform for customers to submit their applications for online company incorporation. This service is available to anyone looking to set up a private limited company limited by shares, following model articles and complying with the Companies Act 2006. However, the Web Incorporation Service is not designed for bulk use, meaning it’s not ideal for customers who frequently file large numbers of company incorporations. For those situations, the Software Filing service is a better option.

Do I need any special software on my computer to use the Web-Based Incorporation

Service?

To get started, you’ll need a PC or Mac connected to the Internet, along with a W3C-compliant web browser such as Microsoft Internet Explorer version 6 or later, Firefox version 3, Safari version 3 or later, Opera version 9 or later, or Chrome version 0.2 or later. Make sure your browser has JavaScript enabled and supports 128-bit SSL. Additionally, you’ll need a functional email address that can receive attachments, as well as Adobe Reader to access the Memorandum of Association and the Incorporation Certificate that will be sent to you via email.

When is the Web-Based Incorporation service available?

The online service is accessible 24/7. It will only be down for essential maintenance during scheduled times, which will be posted on the sign-in screen. Please keep in mind that due to document processing requirements at Companies House, documents can only be reviewed during their working hours, which are from 7:30 AM to 6:30 PM, Monday to Friday.

can I incorporate a new limited company in the UK online at a low price?

To establish a limited company in the UK online at a low cost, individuals can utilize the Companies House web filing service or consider various training packages offered by online agents. The basic fee for online registration with Companies House is £100. However, many registered agents provide packages starting around £104.99, which often include the Companies House fee along with additional services such as assistance in opening a business bank account.

When selecting a formation package, it is essential to understand the registration process to ensure a cost-effective setup for your limited company. If a suitable address for the company is not available, registered office services can typically be purchased from the formation agent. Additionally, some packages may offer extra services, including nominee director services, enhancing the overall support for new business owners.

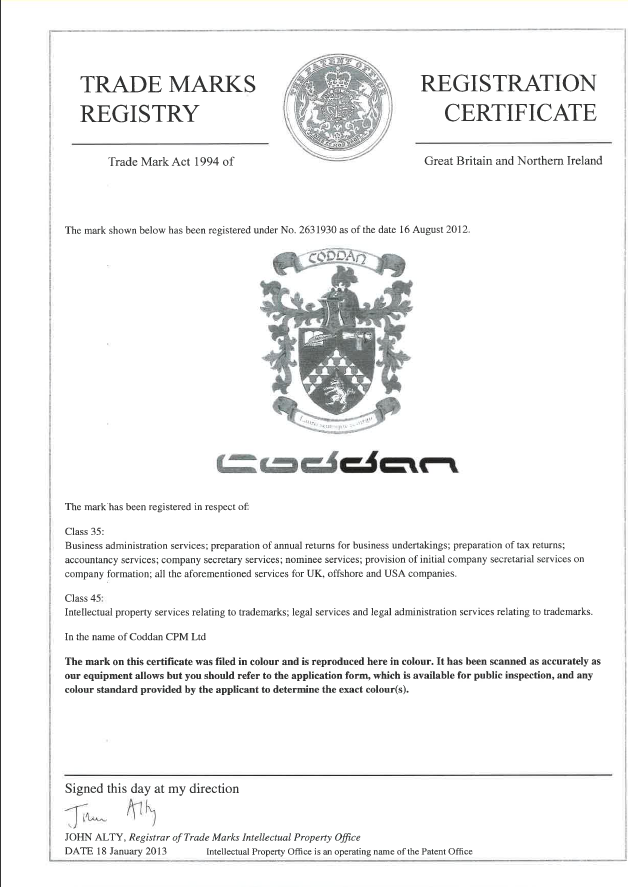

- Coddan: Your Business Formation Service Agent

- Your Authorized Corporate Business Service Provider (ACSP)

- Office Hours:

- City of London, Unit 3, Office A 1st Floor, 6-7 St Mary At Hill, London, EC3R 8EE, GB

9.30 am — 6.00 pm GMT

9.30 am — 6.00 pm GMT Monday—Friday

Monday—Friday info@coddan.co.uk

info@coddan.co.uk