Start Business on Amazon, Free ID Verification Included.

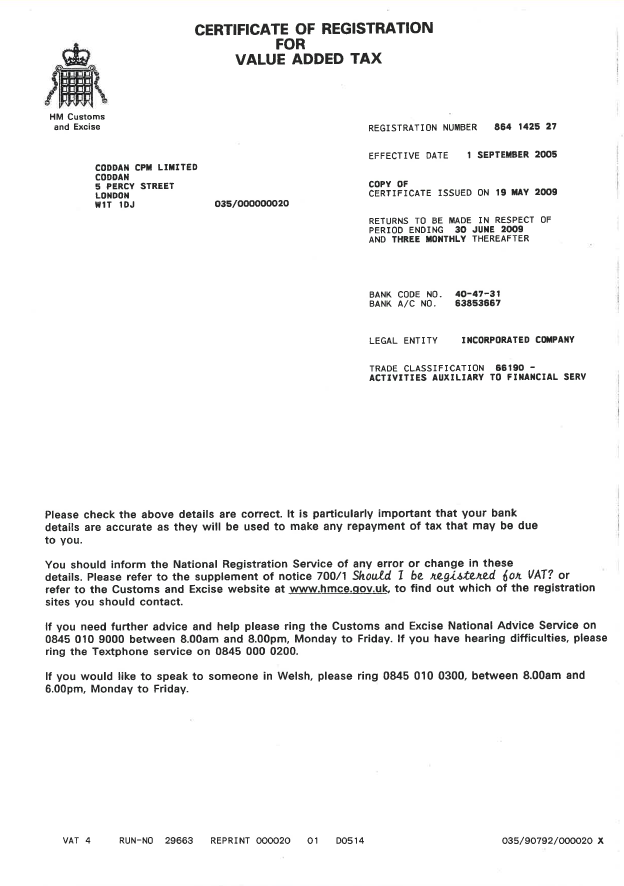

Start your Amazon business with ease; get expert help in selecting the right business structure, setting up a registered office, and getting VAT registration.

Simplify your business setup with expert help on choosing the right structure,, registering your office, and managing VAT for successful Amazon sales.

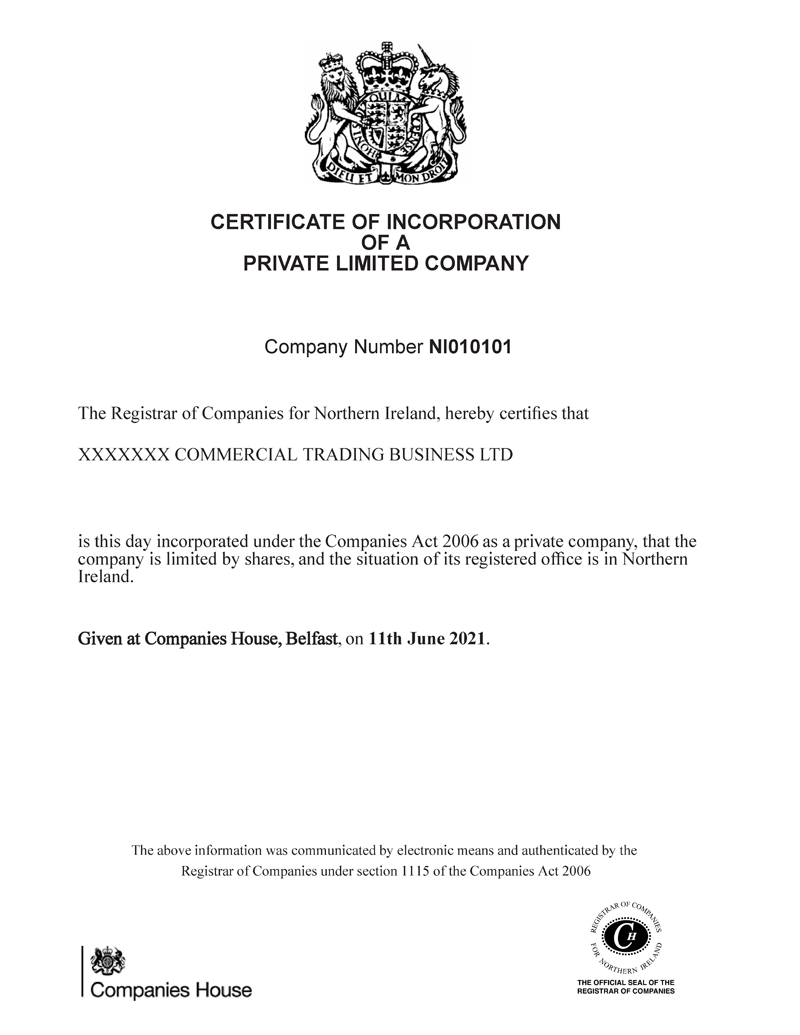

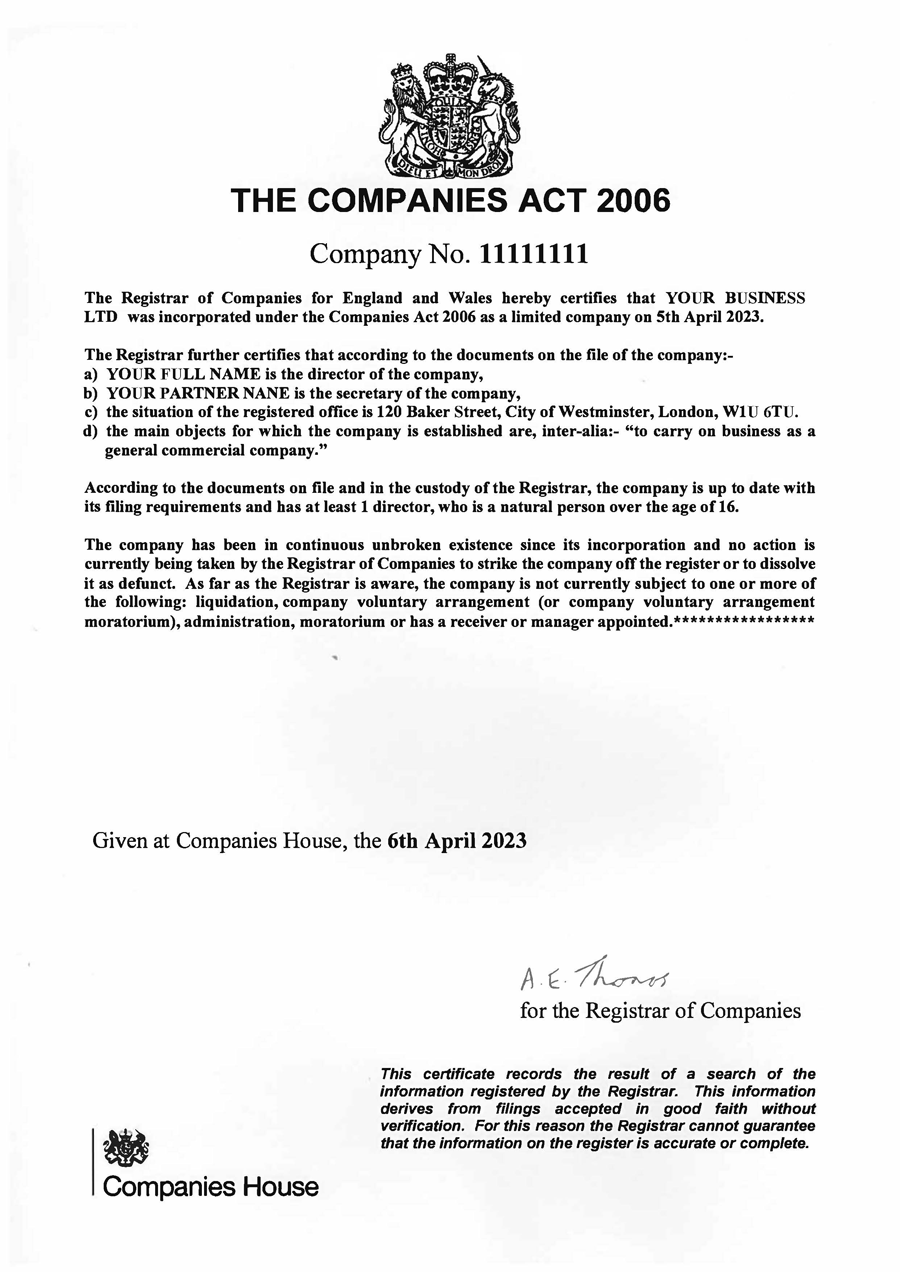

- Start selling on Amazon UK by incorporating your business online with a government-approved ACSP provider, then set up your Amazon Seller account today.

- Optimize your business setup with the ideal structure, secure a registered office address, and streamline VAT registration to launch your Amazon selling journey.

- Streamline your business setup for Amazon selling with the perfect structure, a registered office address, and efficient VAT registration to ensure success.

- Enhance your business efficiency with a legal registered office address in England, Scotland, or Northern Ireland; simplify VAT registration effortlessly.

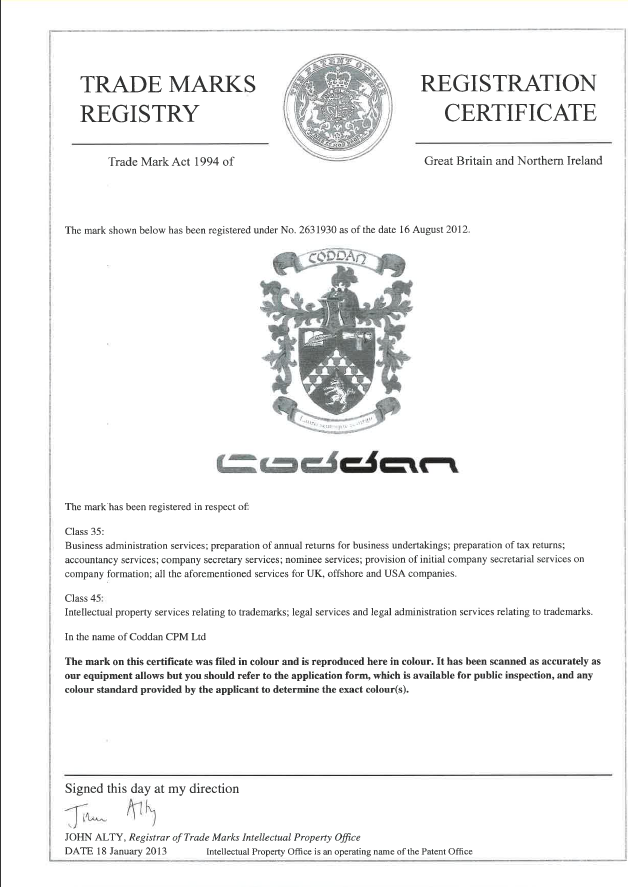

- Register your business with the perfect structure and secure a prestigious London, Edinburgh, or Belfast address; get started on Corporation Tax and EORI today.

- Start your Amazon UK eCommerce journey now; register your limited company within 24 hours and gain access to a professional office and free business banking.

- Start your Amazon selling journey by registering your business online; learn how to navigate the process and comply with government requirements effectively.

- Explore our expert secretarial services focused on statutory records, filings, and corporate governance, tailored to meet your compliance needs effectively.

- Discover the steps to sell on Amazon UK as an Ltd Company; incorporate your business online and register for Corporation Tax with our expert guide.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk