Set up a limited company with a Corporation Tax and UTR number.

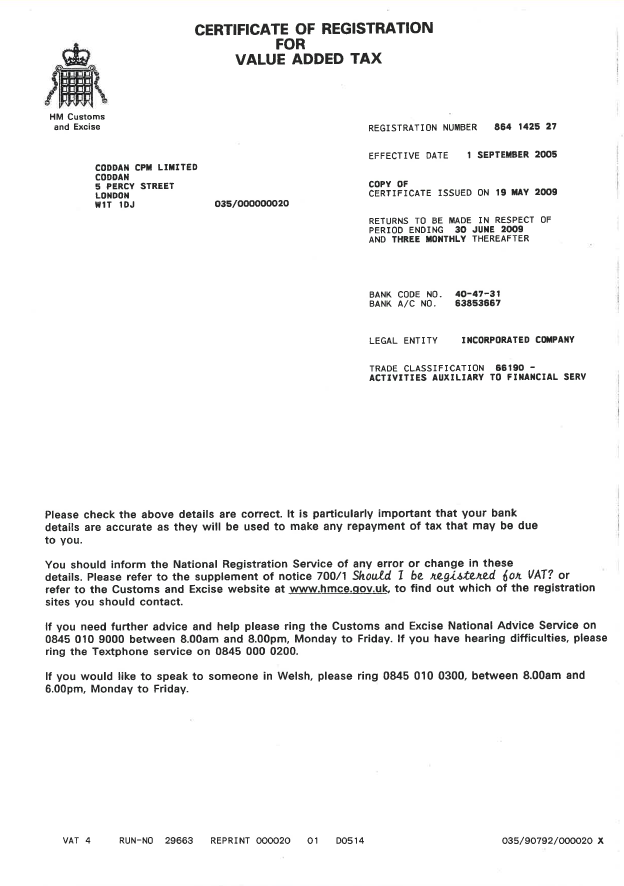

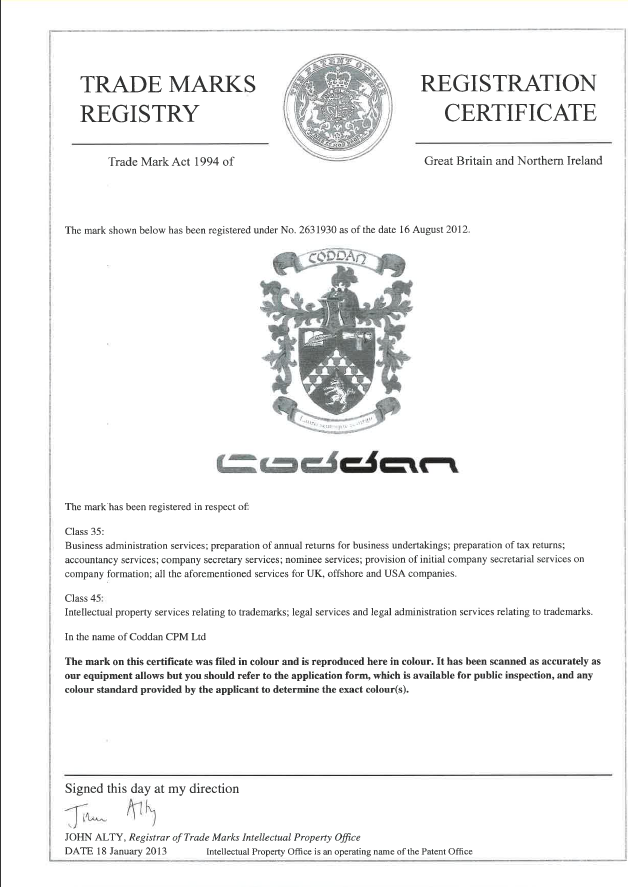

Register your company for Corporation Tax effortlessly with Coddan CPM; our specialists provide expert services for a seamless setup across the UK.

Ensure Your Business is Tax-Ready: The Importance of Registering for Corporation Tax During Company Formation Process.

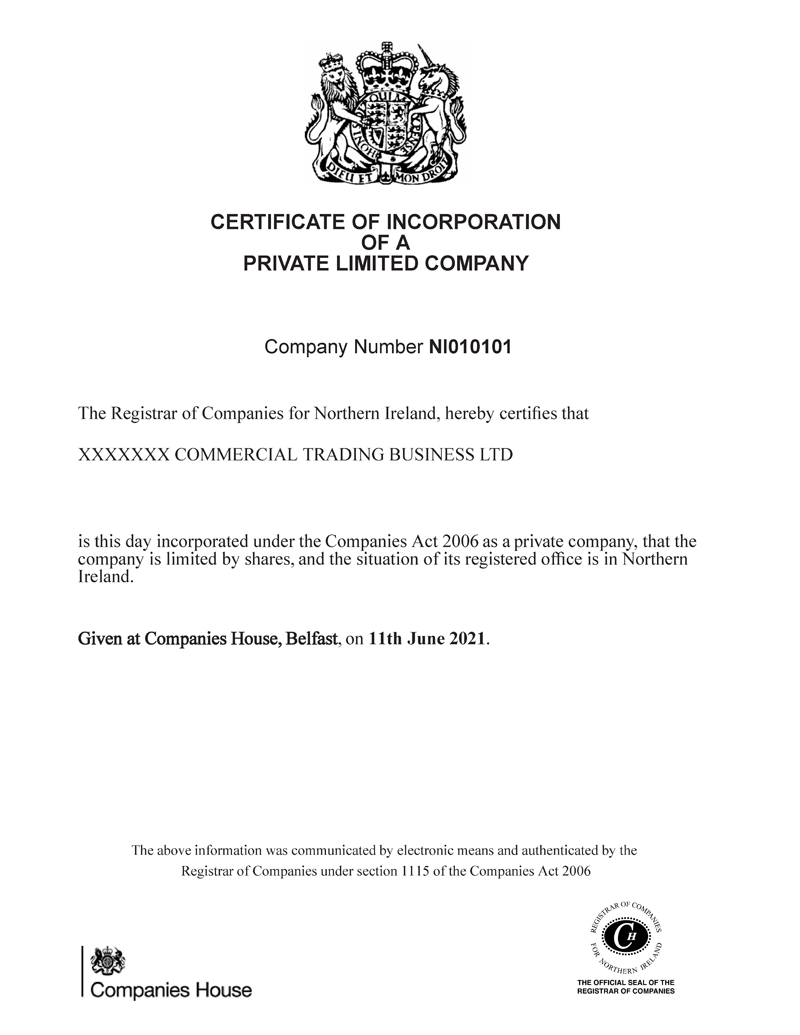

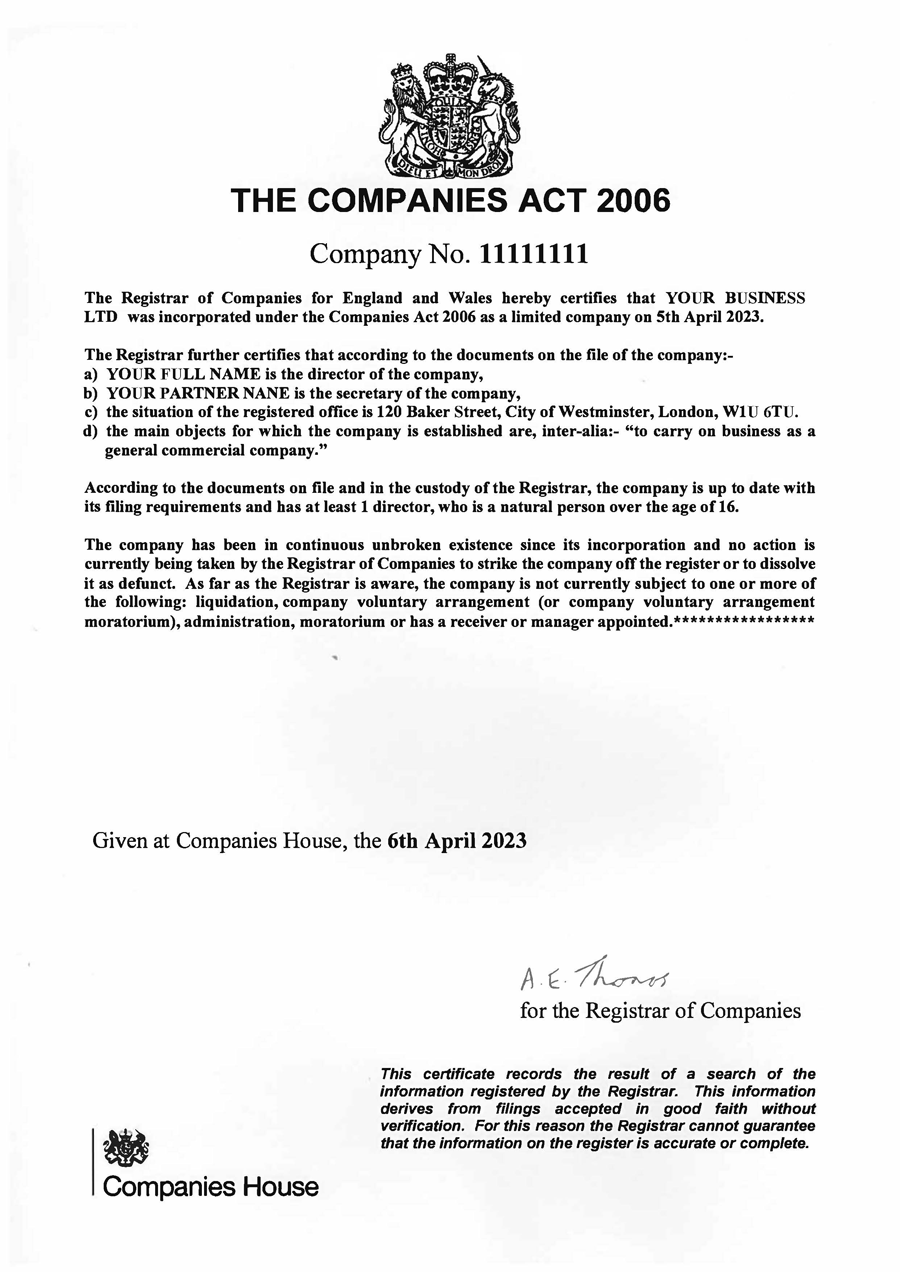

- To set up your company for Corporation Tax in England, first register your limited company online with Companies House, as this is the quickest and most cost-effective method.

- Start your business easily; our formation packages include free HMRC registration for Corporation Tax and a complimentary Unique Taxpayer Reference (UTR) number.

- We can form and incorporate your limited company within a day, and obtain your Corporation Tax reference and Unique Taxpayer Identification numbers.

- Register a company in two simple steps: choose your company name and provide information about yourself and your new company to obtain your company registration and business address.

- To set up a private limited company for Corporation Tax, you must register it, choose a name, prepare the formation documents, and register with with Companies House.

- Company formation starts from £124.99, and with 5-minute online application,our process includes a £50 Companies House fee and provides digital documents.

- All-inclusive AllSet BizPro Service: This package includes corporation tax registration, a physical registered office, an officers service address, and a business address.

- Your limited company will receive a 10-digit Unique Taxpayer Reference (UTR) from HMRC, typically sent by post to your registered office address.

- Submit an application through Electronic Software Filing, and use the UK's web-filing service to create a limited company and register for Corporation Tax with us.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk

To avoid the financial costs of failing to submit your company’s accounts on time, why not seek the assistance of a company like Coddan? We help thousands of companies deal with their corporate affairs and our speedy electronic filing methods guarantee that your Companies House transactions are carried out with the utmost efficiency. Get in touch with Coddan today and find out how our experience and expertise can help your business.