Filing Your Company's Annual Tax Return.

Filing your company's annual tax return doesn't have to be daunting explore our comprehensive resources to streamline the process and meet deadlines.

Learn how to prepare and submit a company's tax return, discover deadlines and penalties for Corporation Tax for late filings to HMRC.

- Learn the straightforward steps to access and submit your CT600 annual tax return with Companies House and HMRC; make tax filing hassle-free!

- Access the CT600 annual tax return and find out how to submit it to Companies House and HMRC effortlessly; streamline your tax process now!

- Simplify your tax obligations with our service to file your Company Tax Return (CT600) for Corporation Tax directly with HMRC; get started today.

- Efficiently file your Company Tax Return (CT600) for Corporation Tax with HMRC; our service ensures compliance and accuracy for your business needs.

- Complete your CT600 Company Tax Return effortlessly; discover essential information and tips for filing your Corporation Tax accurately and on time.

- The CT600 guide provides key insights on return formatting and delivery; equip yourself with the necessary information for a successful submission.

- Log in to your HMRC online account or suitable software to complete the CT600 form, the official document for reporting Corporation Tax efficiently.

- Learn how to accurately complete your CT600 Company Tax Return for Corporation Tax; discover essential information and tips for a successful submission.

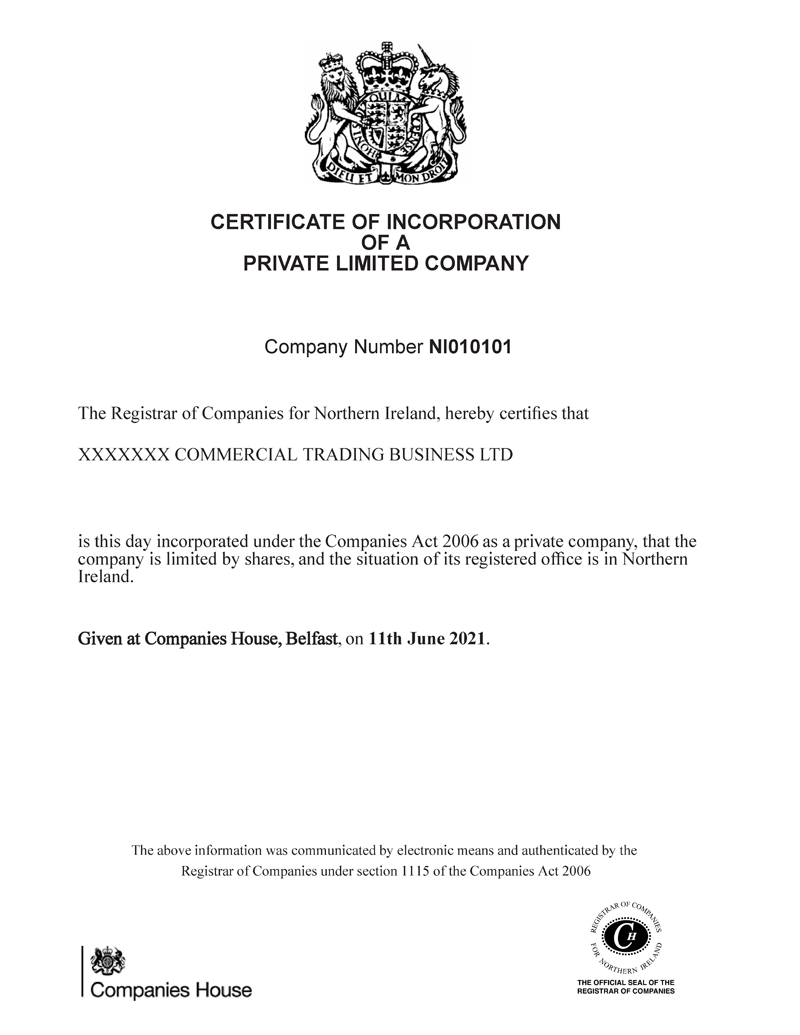

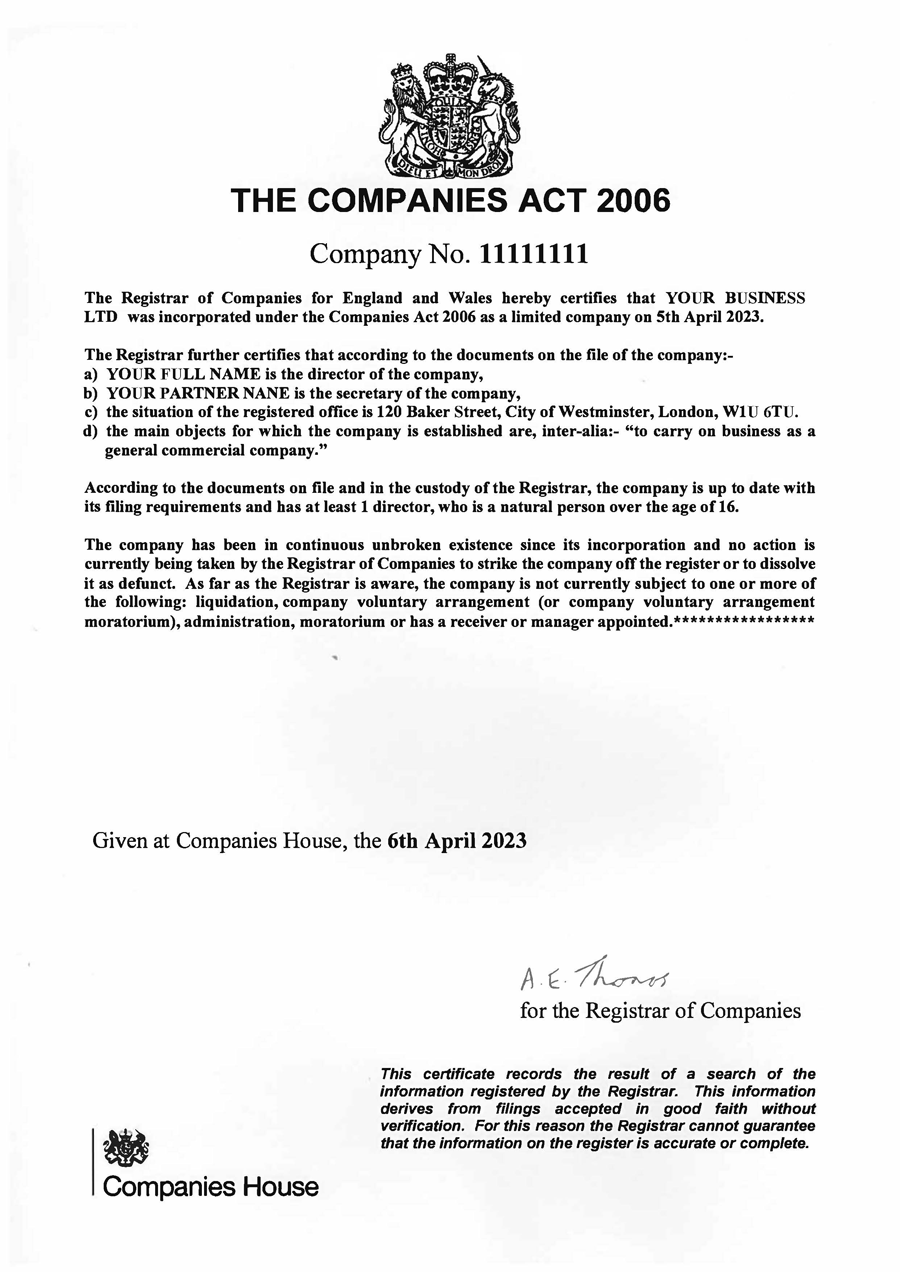

- Submit an application through Electronic Software Filing, and use the UK's web-filing service to create a limited company and register for Corporation Tax with us.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk