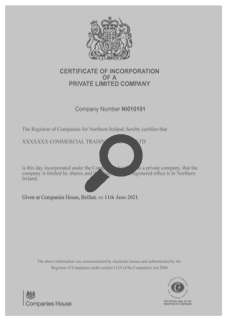

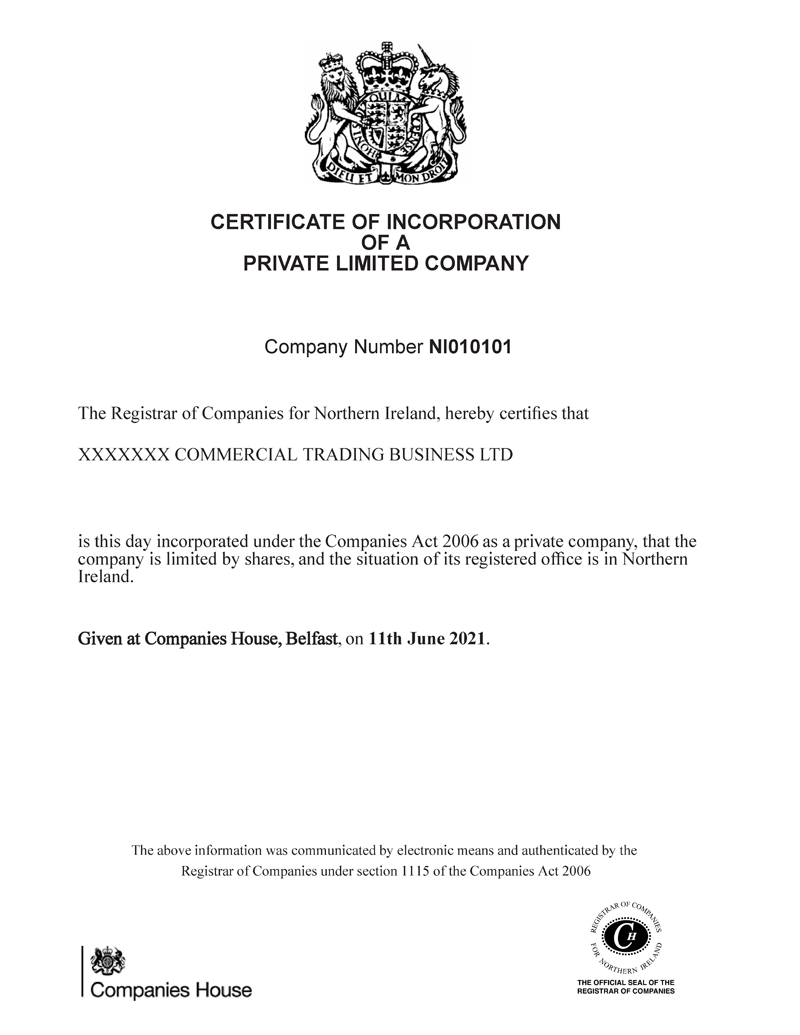

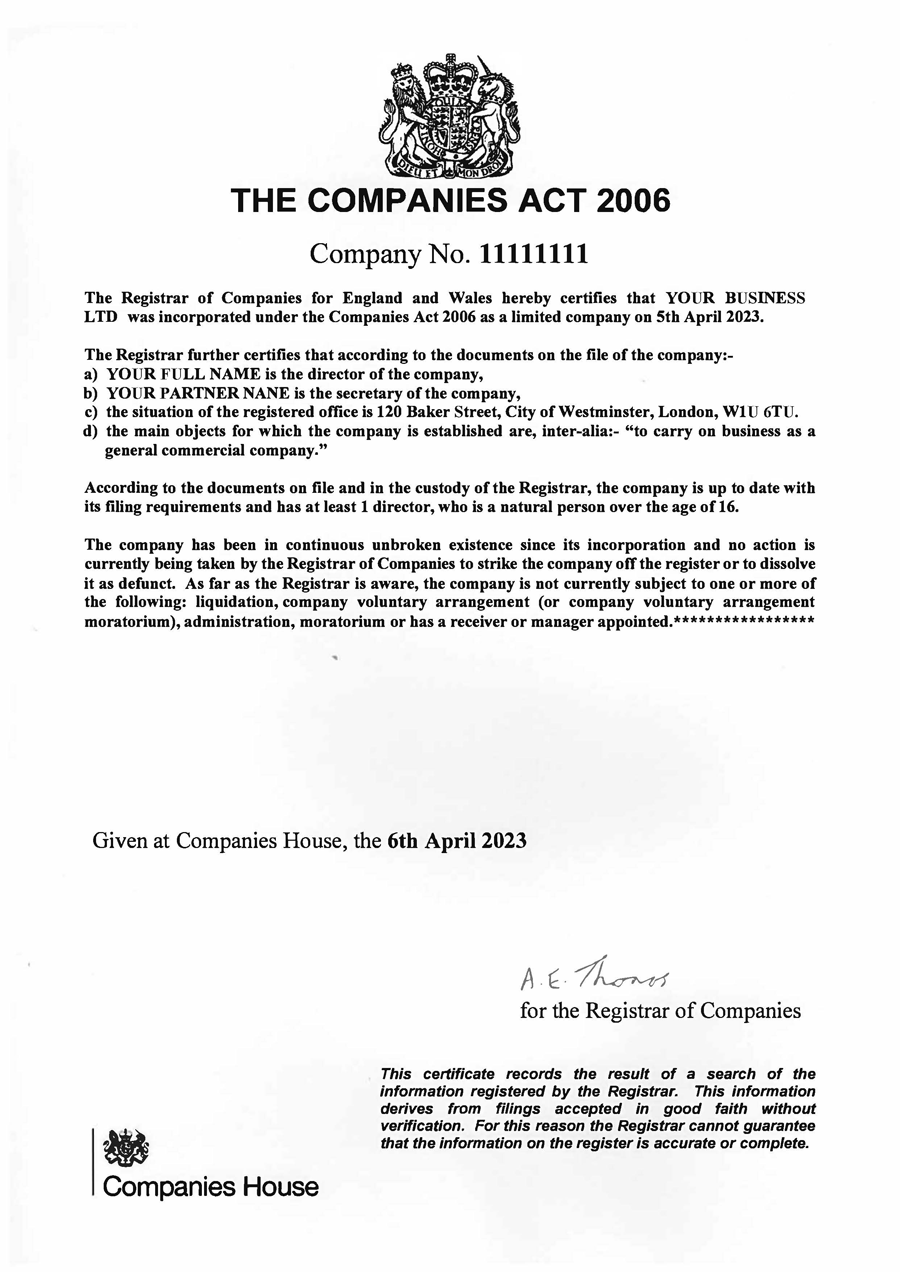

Form IN01 is Used to Get a Company Registered Legally.

The official Form IN01 is a legal document used to register your limited by shares company or limited by guarantee with Companies House.

To form a company in the UK using Form IN01, you must first have a unique company name a registered address, and details for at least one director and shareholder.

- Register a private limited by shares company in 2 fast easy steps, filing your application Form IN01 takes place within 1 business day for only £54.99.

- To form a limited company in the UK, file on electronic application with Companies House using Form IN01 and get it registered for Corporation Tax.

- Anybody forming a UK limited company must complete Form IN01 and submit it to Companies House, the Registrar of Companies, by post or online.

- The IN01 Form is the official Companies House application form used to register a new UK company, defining its legal identity and registering its name.

- The formation plan for a private limited company by shares includes a registered office address in England for one year, with an annual renewal £45 fee.

- The Form IN01 is used to register a corporation, requiring details of the limited company, directors, secretary, and a registered office address.

- To form a private limited by shares company or a company limited by guarantee in the UK, file an application with Companies House using Form IN01.

- You can create a private limited by guarantee or limited by shares company online or by post via the Form IN01, complete the application form in 5 minutes.

- Form IN01 is the official

Appliction to register a Company

with Registrar of Companies in the UK, ensure your business is officially get recognized. - Learn how to create a UK company with Form IN01 and get ID verified simply; Form IN01 is an application form used to create a public or private company.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk