e-File Your Nonprofit Company Annual Confirmation Statement Online.

To file a confirmation statement, submit it online at Companies House for only £75, instant e-filing nonprofit statement—use a 24 hour express platform.

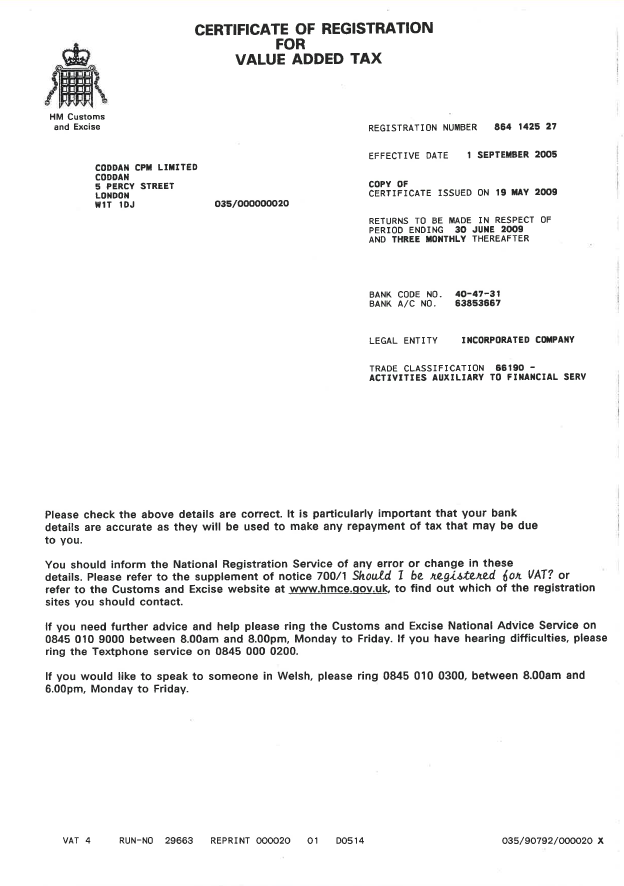

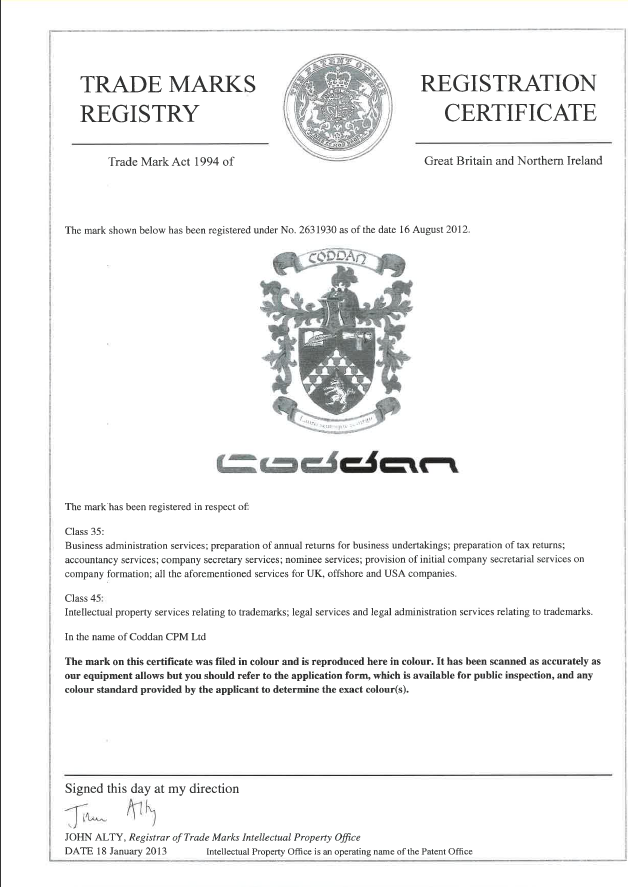

Coddan offers a service to file confirmation statements, which update limited by guarantee details, an on-time filing with Companies House.

- Coddan professionals provide a confirmation statement filing service, which will ensure you keep a company limited by guarantee legal and compliant.

- Get the UK's cheapest confirmation statement service, we will file your Ltd Company Limited by Guarantee Annual Return quickly and accurately.

- Your company limited by guarantee confirmation statement will be filed within 1 working day of receiving the required information and payment.

- File your confirmation statement for a registered company limited by guarantee (LBG, NGO) with Companies House online at affordable costs.

- Same-day LBG Company Formation with NGO-companies ensures you get easy and express incorporation or NPO registration right when you need it.

- We will file a confirmation statement for nonprofit organisations registered in England and Wales, Scotland or Northern Ireland electronically fast and secure.

- To file a confirmation statement, submit it online at Companies House for £75 annually through our iXBRL Web-Based Filing software and simple portal.

- File your Companies House Confirmation Statement (CS01) for non-commercial business organisation (limited by guarantee), including co-ops online.

- Express Service within 24-hour filing process for £75+VAT available for all types of limited by guarantee companies registered in the UK jurisdictions.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk