Complete and Submit the Confirmation Statement Online.

Use our online submission service at Companies House; it takes just 24 hours for only £75, get a Confirmation Statement easily filed online.

To file a confirmation statement, submit it online at Companies House for only £75, instant filing it–use a 24-hour express electronic service.

- You can file your confirmation statement directly with Companies House or through a third-party qualified and licensed formation agent service firm.

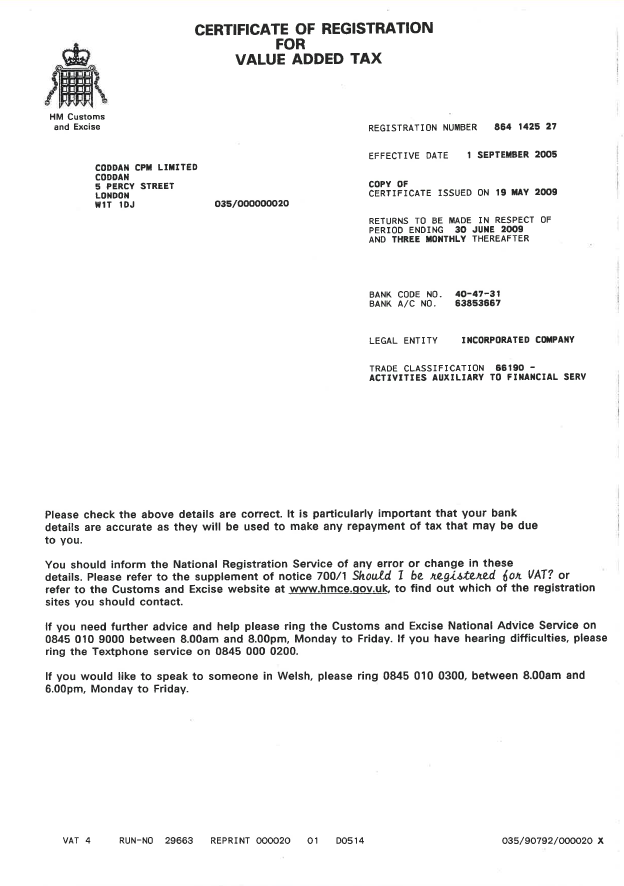

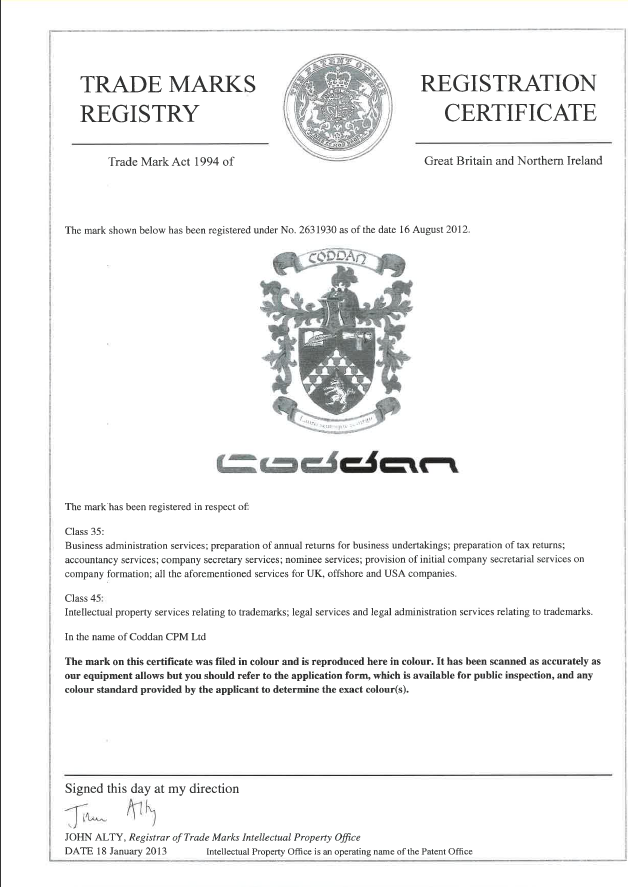

- At Coddan CPM, we offer Company Confirmation Statement digital filing for just £75 within 24 hours, it includes the official government e-filing fee.

- Our inexpensive express documents filing service will file your company statement with Companies House within 24 hours (excluding weekends and bank holidays).

- To file by post, download and fill in a confirmation statement form and send post it to Companies House office, the official CH address is shown on the form.

- It's very easy to file a confirmation statement online with us, it takes a maximum 24 hours and costs you only £75+VAT, filing the necessary including Companies House fees.

- An Authorised Corporate Service Provider (ACSP) can help with ID verification for the confirmation statement process by verifying directors’ identities and submitting filings.

- Coddan offers a service to quickly file annual confirmation statements, which update company details, and ensures on-time easy filing with Companies House.

- The fast-track filing confirmation statement for your company or filing response with government authority will be available the same day by 4:00 p.m.

- A confirmation statement (CS01) includes essential company details and must be filed annually by all Limited (LTD) Companies or LLPs, even if they are dormant.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk

Filing a Confirmation Statement might seem simple, but even a minor error can lead to larger issues. If you prefer to avoid the details and leave it to the experts, Coddan is here to help. We will handle everything for you, ensuring that your filings are accurate, timely, and hassle-free. Contact our team based in London today, and let us manage your compliance needs while you concentrate on growing your business.