The minutes of the first board meeting and issue share certificates.

Explore the minutes of the first board meeting and understand the essential steps involved in issuing share certificates for your company.

Learn how to effectively address key foundational matters in your company’s first meeting after incorporation, setting the stage for growth and stability.

- Company formation starts at £54.99 with a 5-minute online application; the process includes a £50 Companies House fee, and documents are delivered digitally.

- Create a limited company in minutes for just £54.99; get your certificate of incorporation within one business day and enjoy a free business bank account.

- Register a UK Ltd company and begin trading within 24 hours; we offer the best packages and business bank accounts to help you start your business.

- Register your company quickly and easily with the UK’s top formation agent; form your company through our straightforward two-step process.

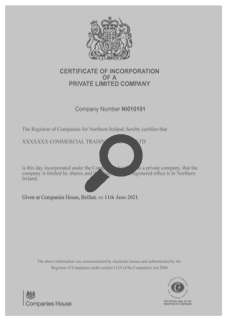

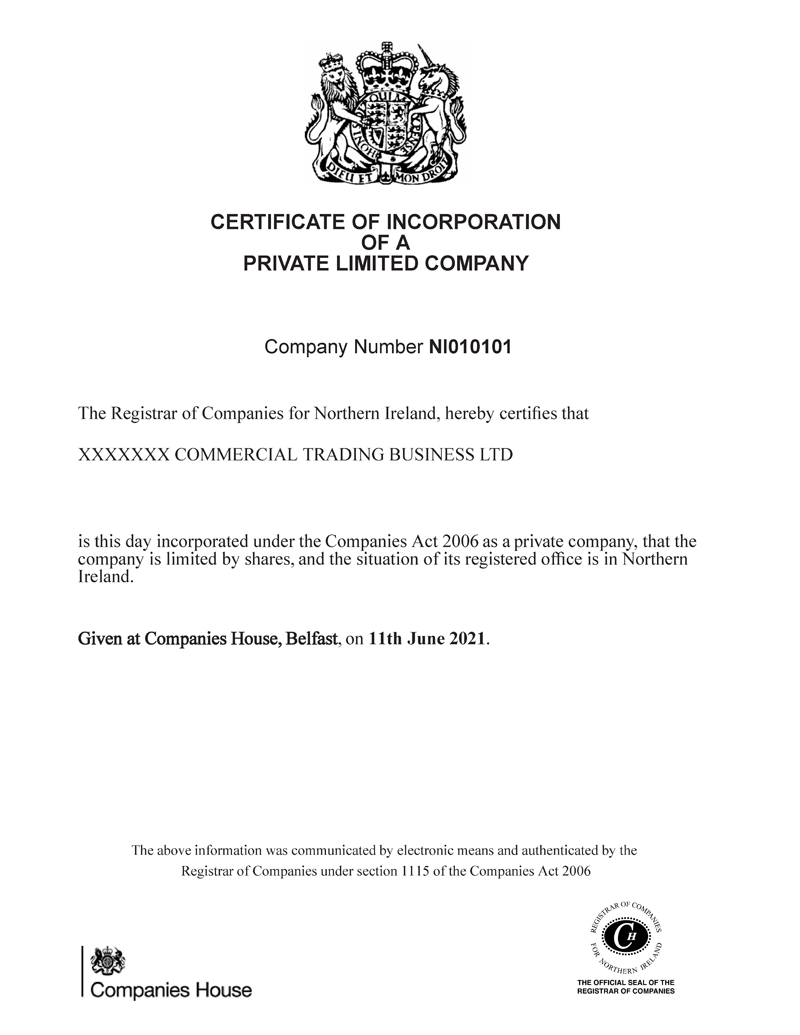

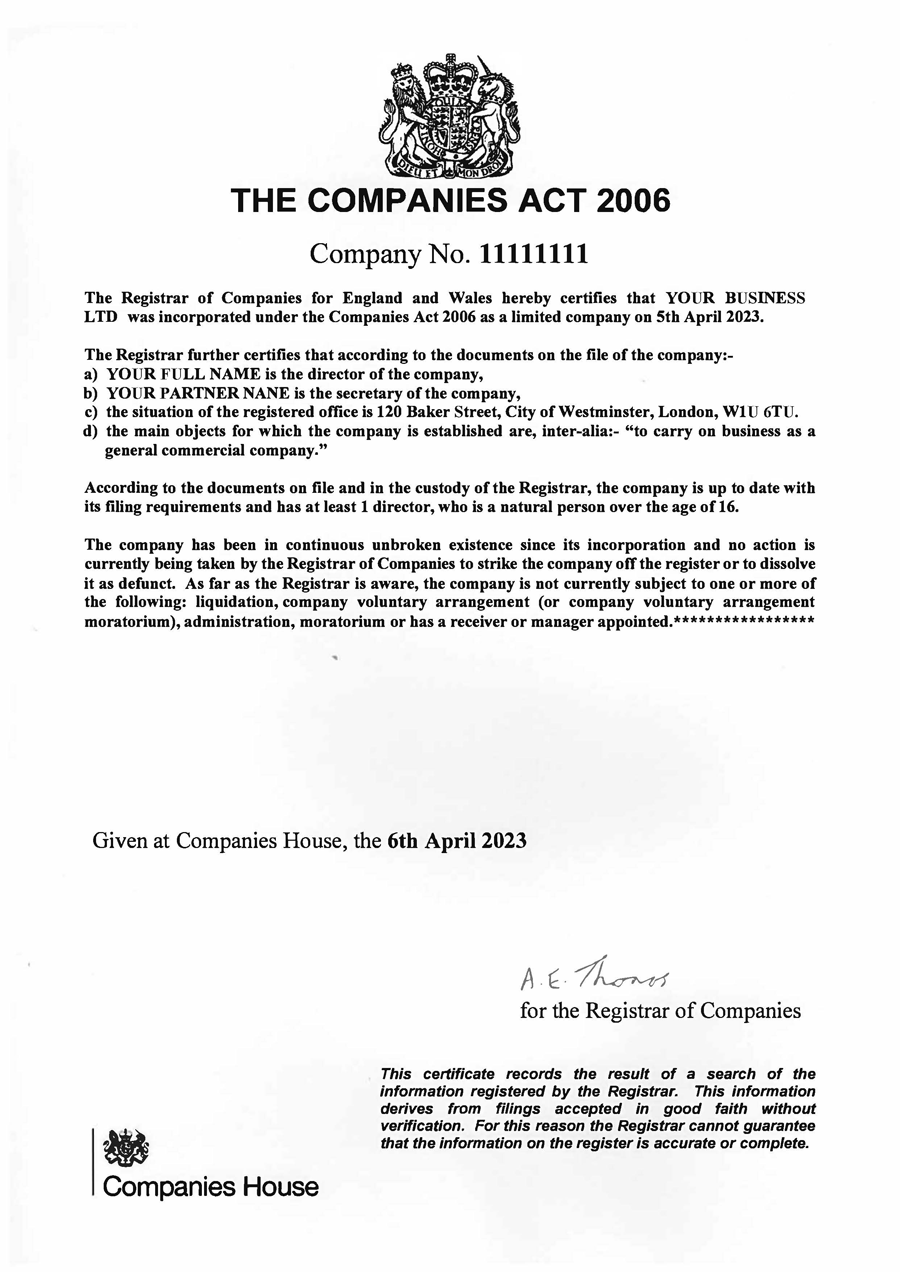

- Fast incorporation Services: submit an order, and we will provide you with a Certificate of Incorporation and a Company Registration Number within 24 hours.

- To establish a private limited company, you must register it, select a name, prepare the necessary documents, and submit your registration to Companies House.

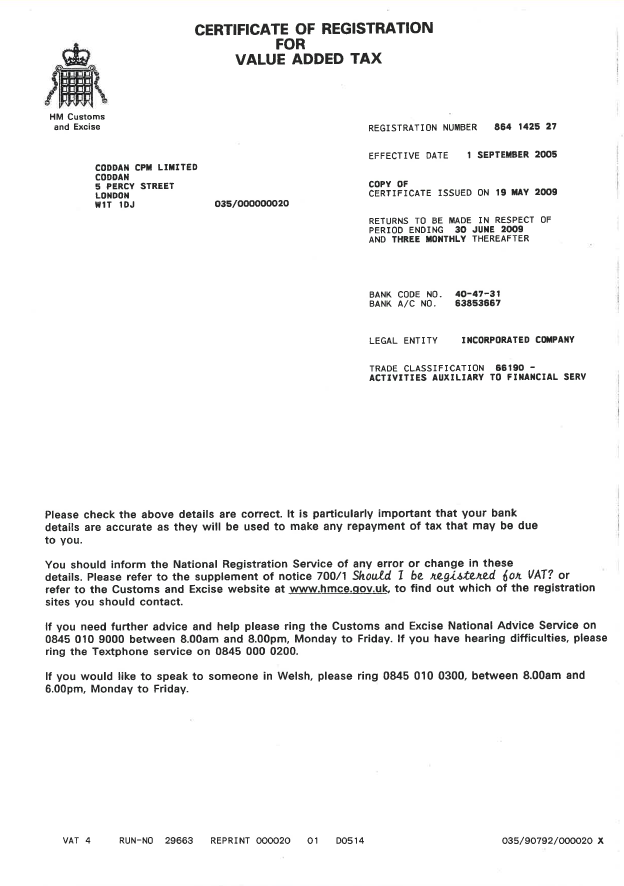

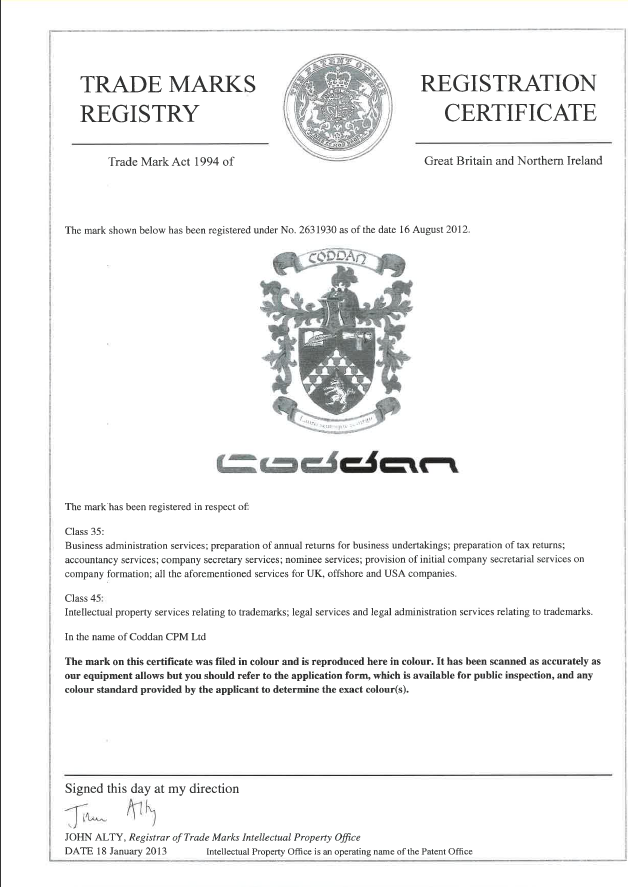

- Coddan provides simple company formation packages starting at £54.99, includes a certificate, and document processing, with same-day registration available.

- An official certificate of incorporation is sent to you electronically and by post, along with a hardback statutory limited company register.

- Learn how to obtain a Company Registration Certificate in the UK with a straightforward guide covering legal steps, naming rules, and required documents.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk