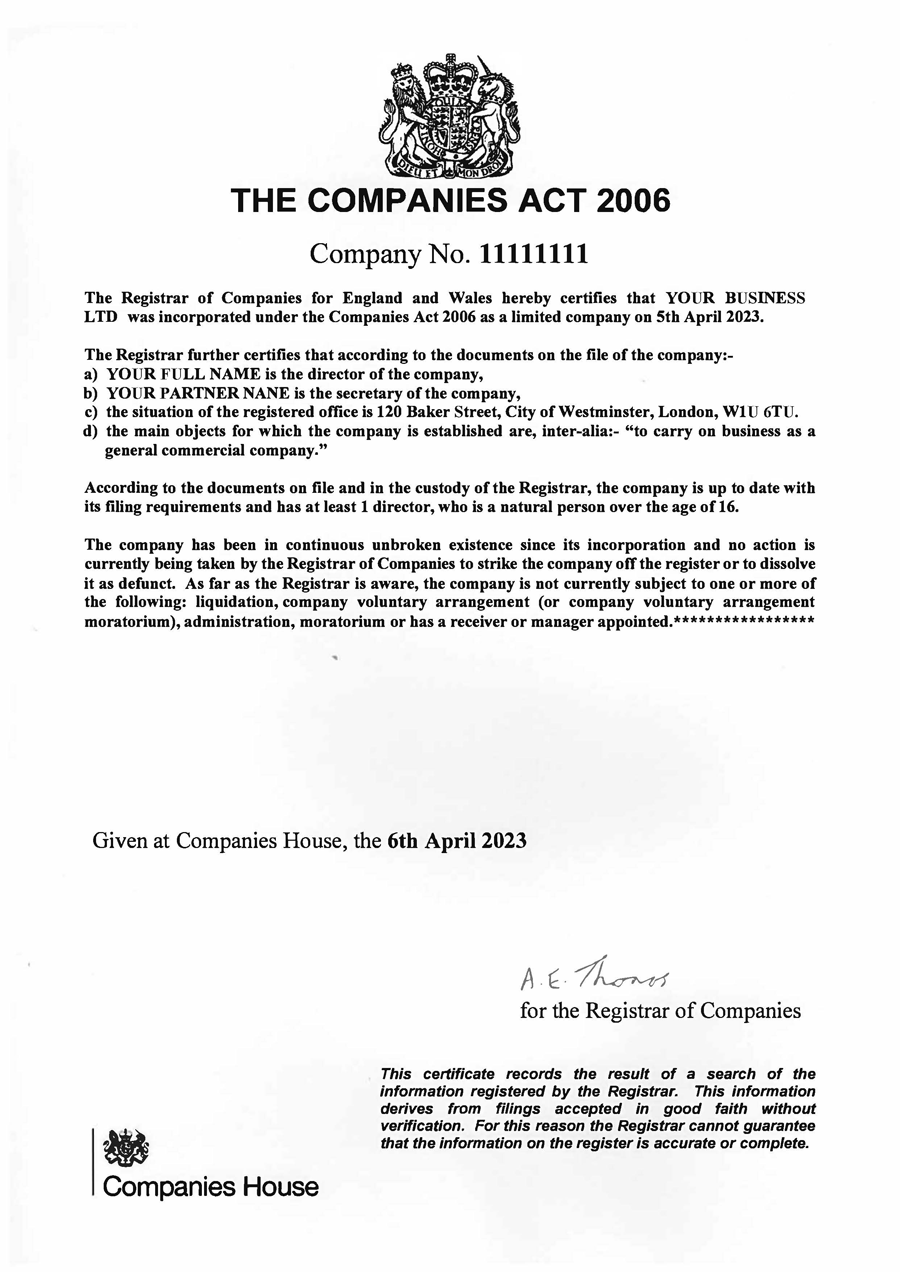

Instantly Verify Your ID for Company Formation.

Ensure compliance during company formation with mandatory ID checks for directors and Individuals with Significant Control; learn more about the process today.

Ensure a smooth incorporation process by providing your Unique Identification Code; learn how to register your company efficiently with our expert guidance.

- Streamline your company registration by understanding the role of the Unique Identification Code for directors; get expert tips for a successful incorporation process.

- From autumn 2025, ID verification will be mandatory for all new directors and PSCs at the time of company incorporation or appointment; learn more now.

- New regulations from autumn 2025 require ID verification for directors and PSCs at company incorporation or appointment; get the details to stay compliant.

- Form your new company swiftly in the UK with integrated ID verification; trust an Authorised Corporate Service Provider for the fastest service available.

- Start your business in the UK quickly and securely; use an Authorised Corporate Service Provider for seamless company formation and ID verification.

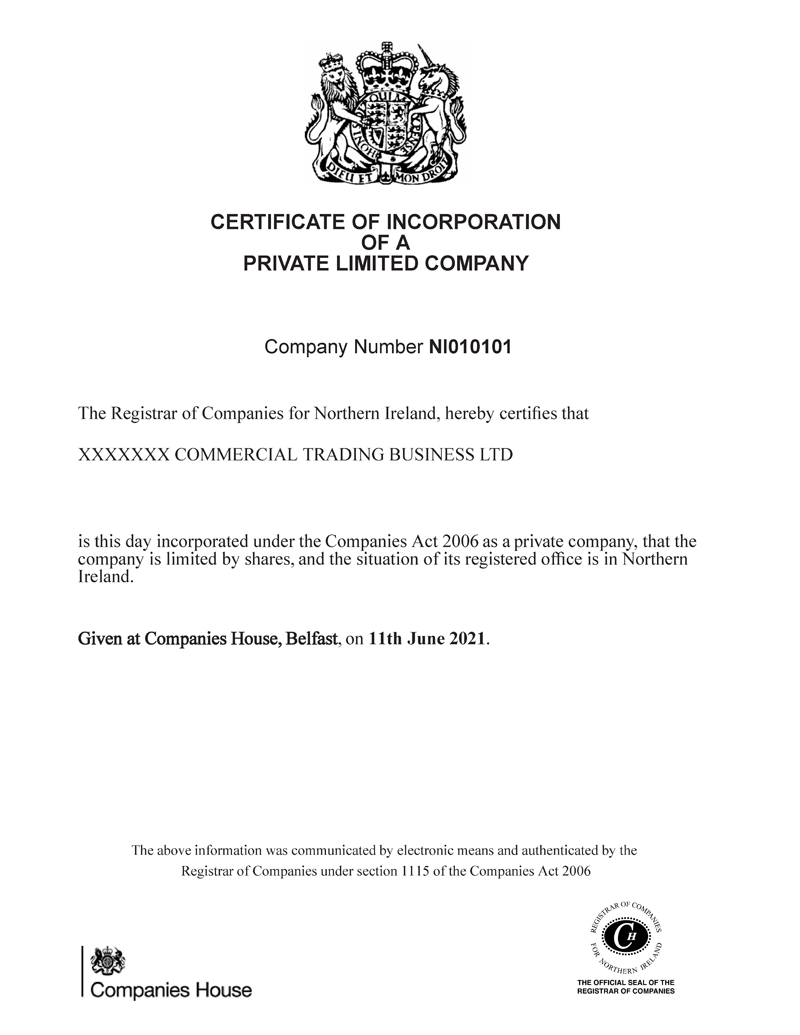

- Simplify your private limited by shares company formation with our expert guidance on proof of ID; enjoy a hassle-free setup for your new business today!

- Start your business corporation effortlessly; our expert guidance on proof of ID ensures a smooth and hassle-free

Ltd Company

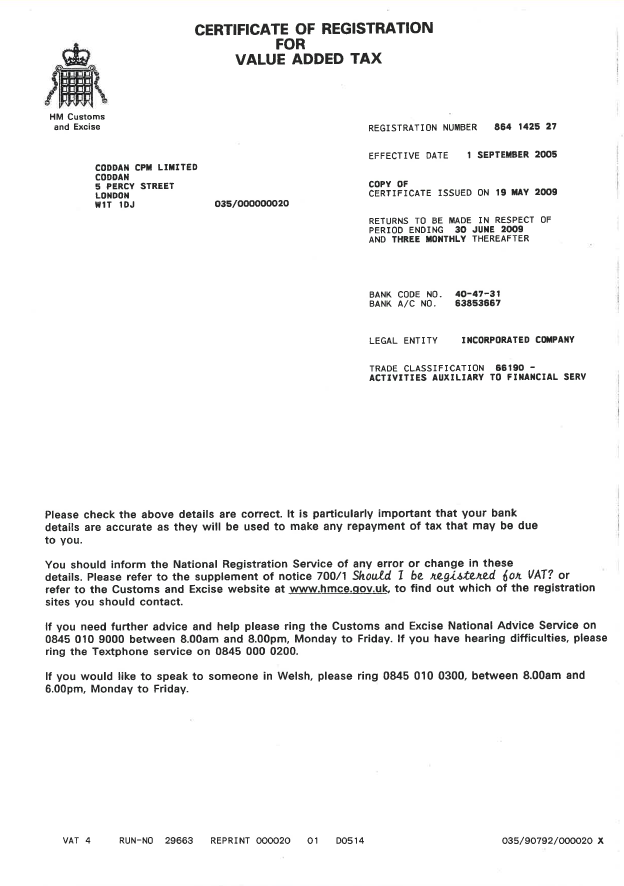

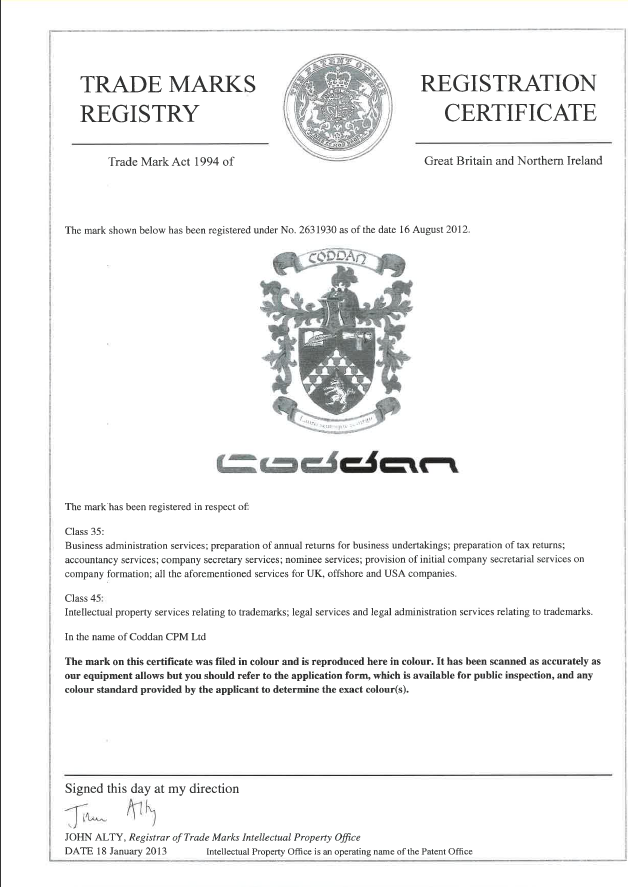

formation process. - Fast-track your UK limited company registration and open a business account on the same day with Coddan ACSP, your trusted licensed provider.

- Get your UK limited company registered and business account opened the same day with Coddan ACSP; quick, reliable service from a licensed expert.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk