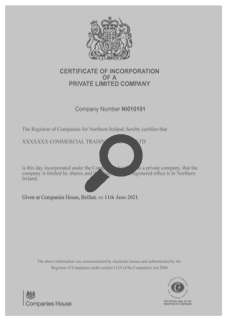

Fill Out the Application Form IN01 Electronically or by Mail (Post).

To file an incorporation Form IN01, log in to the Companies House online service, select official form and click on the option to file an IN01 Form online or by post.

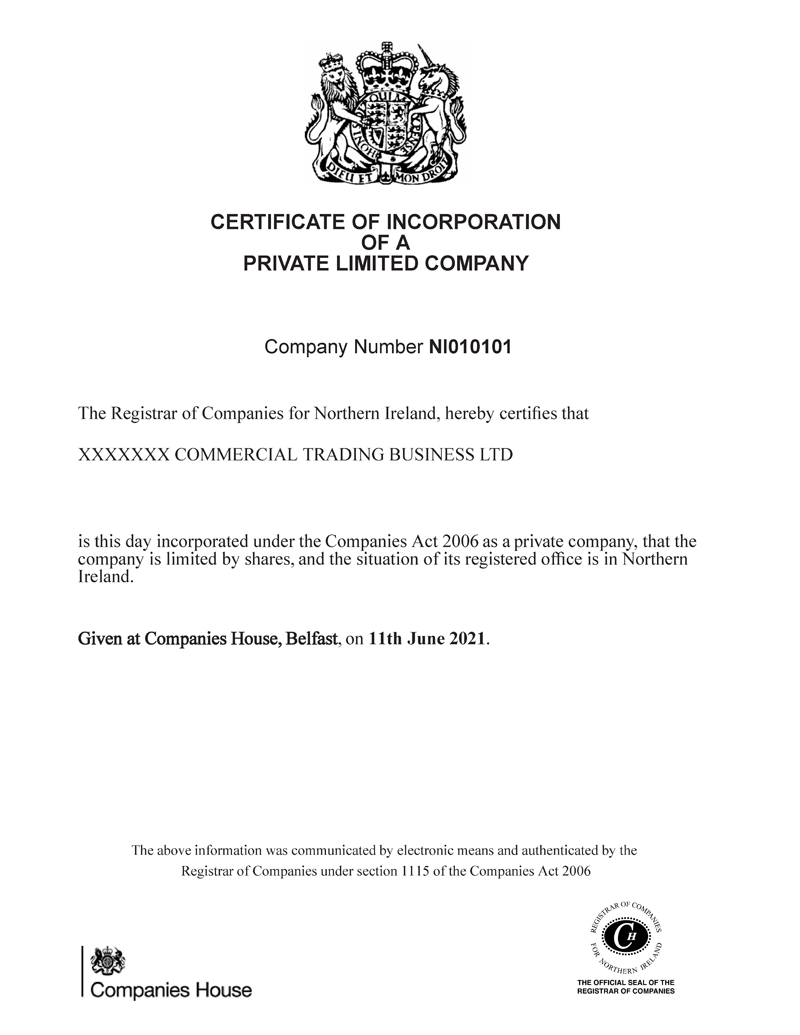

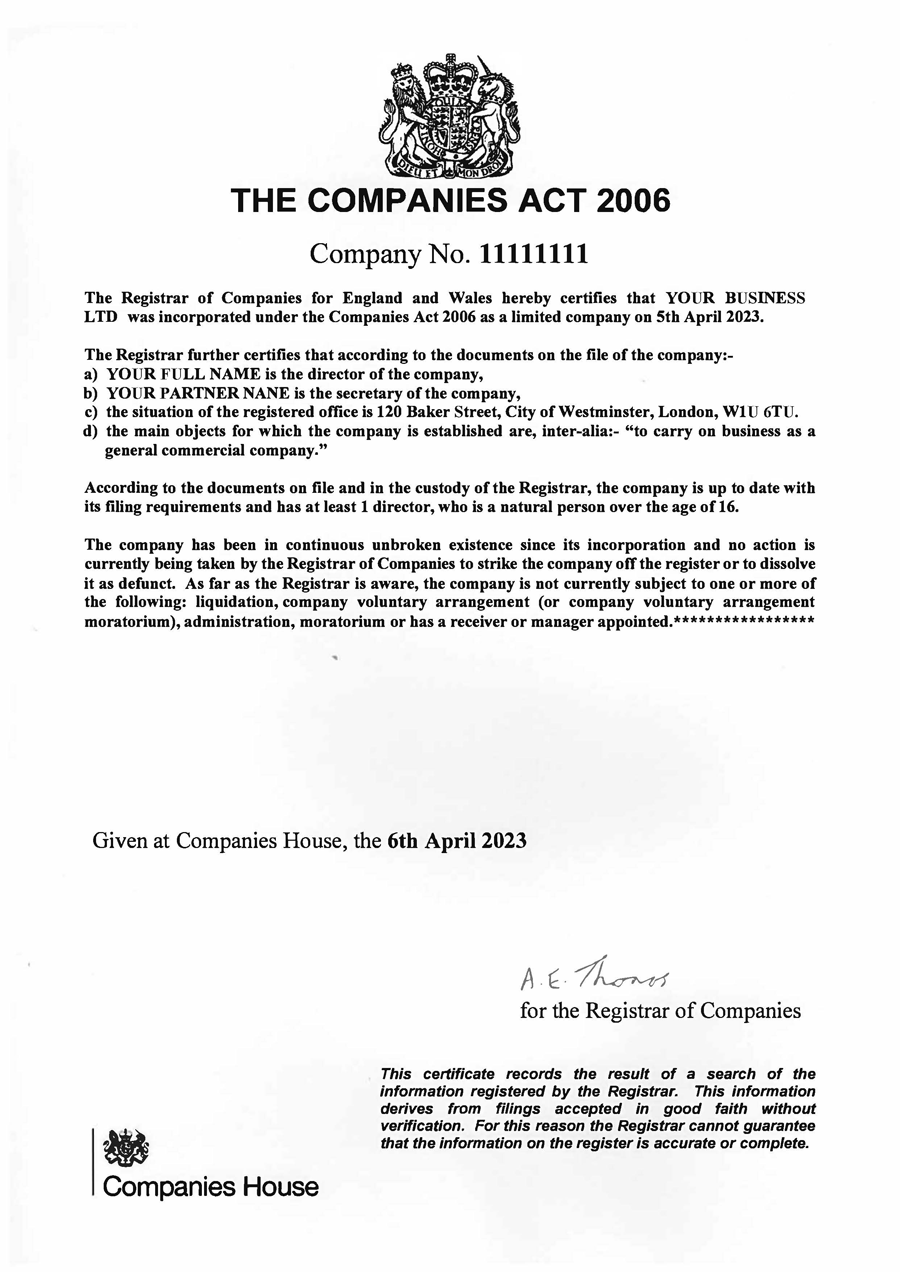

Professional registration of a private company limited by shares via filing and submission the official Form IN01 electronically or sending it by post.

- Register a private limited by shares company in 2 quick simople steps, your application Form IN01 filing takes place within 1 working day for £54.99 only.

- Everything you need to know about filing legal incorporation Form IN01 and maintaining your private or public company at Companies House register.

- Incorporate a limited by shares company or limited by guarantee in England and Wales by filing and submitting the Form IN01 to Companies House in Cardiff.

- At top-quality new UK company set up by using the electronic or paper format formal Form-IN01 professionally filed and submitted at low cost.

- File your official IN01 Form with Companies House, to register it, choose a name, prepare documents, and register with Companies House electronically.

- You can register a private limited by guarantee or limited by shares online or by post via the Form IN01, complete the application in 5 minutes on our website.

- Learn how to register a UK company with Form IN01 and avoid common mistakes, Form IN01 is an application form used to register a company.

- The IN01 Form is the official document for registering a UK company limited by shares (with share capital), or limited by guarantee at Registry of Companies.

- To establish a private limited company in England, you need to register your company with Companies House by submitting an online application

Form-IN01

.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk