Instantly Director Resignations for UK Ltd Companies.

Learn a quick and straightforward way to remove and resign directors from your private limited company while ensuring compliance with Companies House using our service.

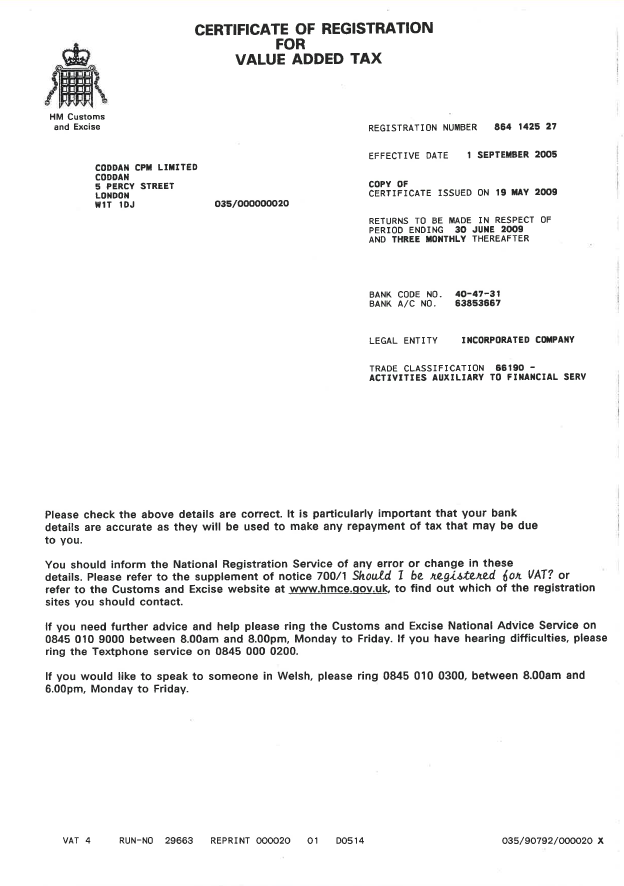

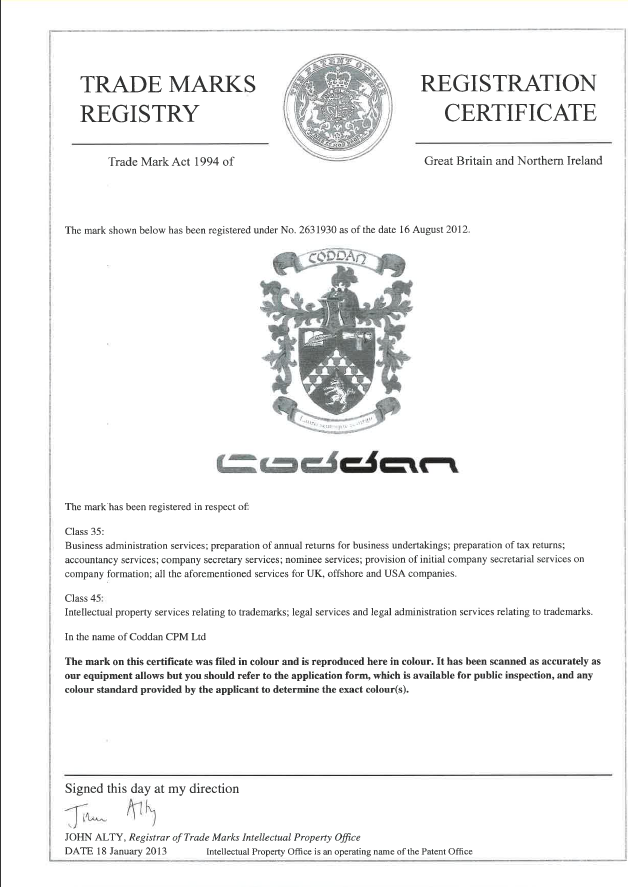

Professional assistance for director termination, removal, and resignation to guarantee legal compliance and seamless process with Coddan.

- Expertly navigate the process of removing or resigning a director from your company anywhere in the UK; trust our specialists for seamless service.

- Coddan offers expert support for director terminations and resignations; ensure legal compliance and seamless transitions with our professional services.

- Our expert lawyers in London provide guidance and share scheme implications, helping you minimize future disputes effectively.

- Ensure a smooth director removal process with our skilled lawyers; we offer insights on procedures and share schemes to help prevent future conflicts.

- If you need to remove a director (key managerial personnel) from your company, our expert team for a free consultation and take the first step today!

- Our expert corporate secretarial team ensures smooth director terminations, providing clarity and precision for both companies and directors.

- Trust our corporate secretarial team to handle director terminations efficiently, ensuring clarity and precision for your business needs.

- Trust our specialists to guide you through the director removal process, ensuring full compliance with legal standards and company regulations for a smooth transition.

- We provide expert support for directors and shareholders in the removal process, ensuring adherence to legal requirements and company policies for seamless execution.

- Streamline your director resignation with our comprehensive service; we take care of all filings with Companies House for a smooth transition.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk