Instantly Director Appointments for UK Ltd Companies.

Learn a quick and straightforward way to appoint and register directors for your private limited company while ensuring compliance with Companies House using our service.

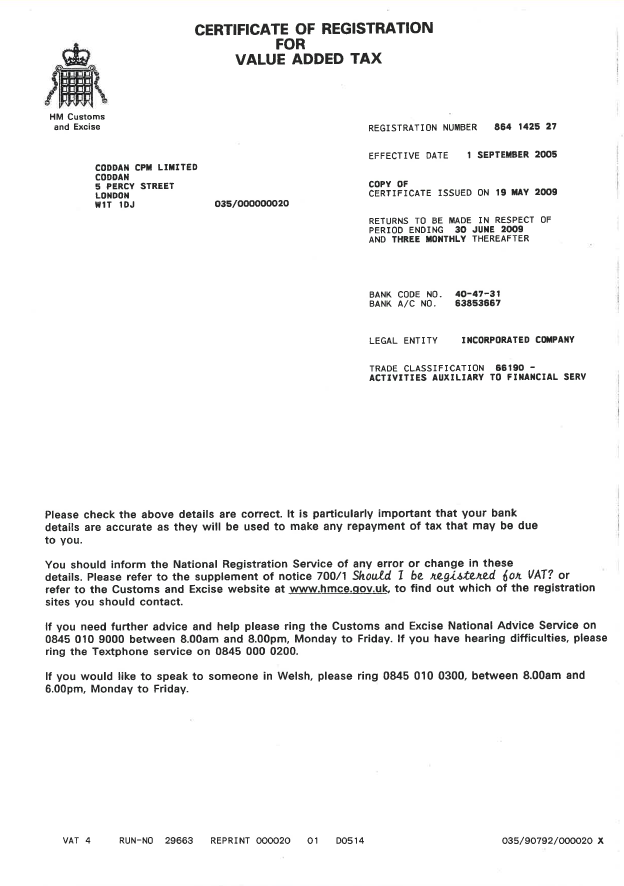

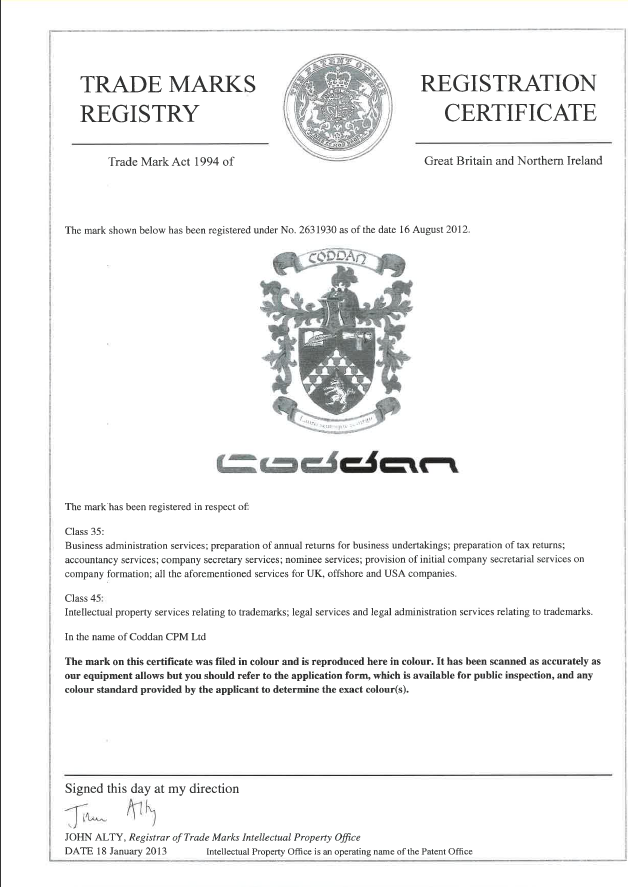

Professional assistance for director appointments, assignments, and changes to guarantee legal compliance and seamless registration with Coddan.

- Ensure proper management of director appointments and apportionment with Coddan, featuring quick, compliant Companies House filings and complete legal documentation.

- Learn about the legal procedures, potential risks, and necessary actions involved in appointing, or registering Key Managerial Personnel (KMP) within a UK company.

- Companies notify the Registrar of Companies (RoC) about changes in key managerial personnel using the official e-forms Form AP01 or TM01.

- Appointing a director (AP01) requires a majority approval by the company’s members or existing directors and must be reported to Companies House.

- On appointment, all directors (executive and non-executive), must signify consent to the appointmentby signing form AP01 during a new company formation.

- To fast-track appointing a director in a UK limited company, use online services like Coddan to handle the digital filing (AP01) with Companies House.

- The core steps involve checking company articles, getting the new director’s consent (with details like their service address & DOB), and notifying Companies House.

- The new company director receives a unique personal code UIN from Companies House after an online ID check,which they give to you to file.

- Using an online ACSP agent automates form filling and electronic filing, making the process swift and compliant with Companies House rules.

- To appoint a director, gather the director info, complete a board resolution, notify Companies House, and update limited company public records.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk