Smooth Corporate Transitions: Director Appointment and Termination Services.

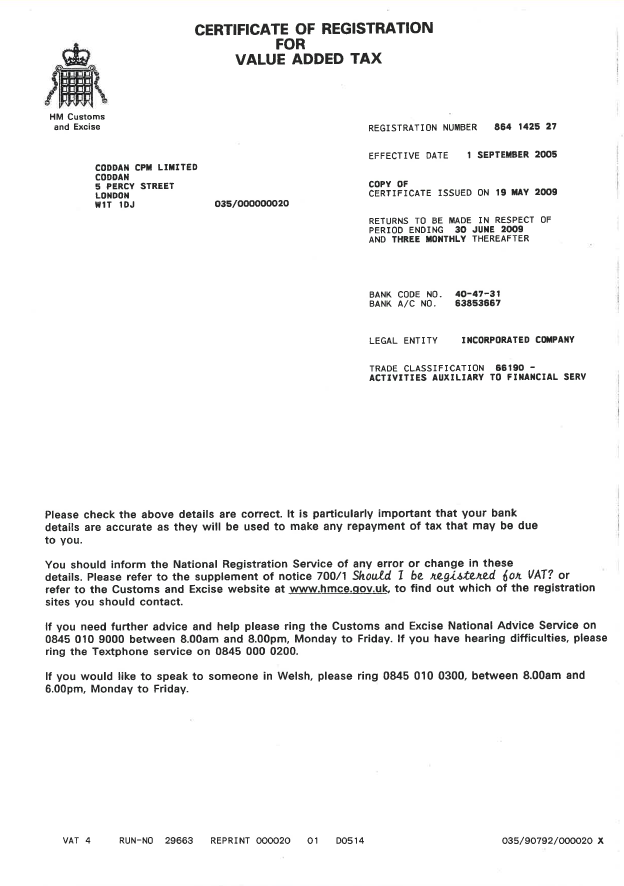

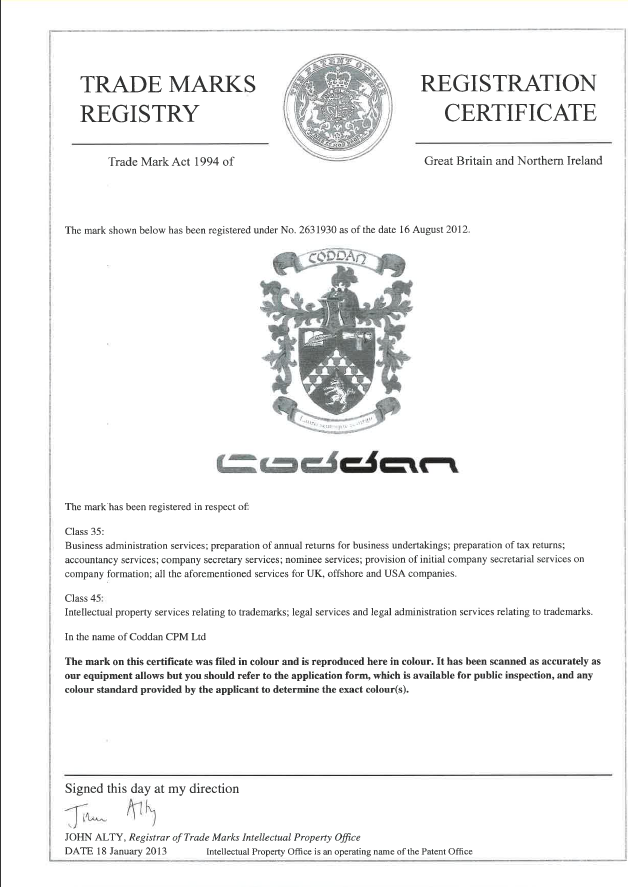

Streamline your director appointment and resignation process in the UK with Coddan ACSP— efficient, reliable services tailored to your business needs.

Ensure smooth corporate transitions with our expert director appointment and resignation services, designed for full legal compliance and peace of mind.

- Coddan ACSP offers expert director appointment and resignation services in the UK; ensure smooth transitions and compliance with our professional support.

- Streamline your corporate transitions with our professional director appointment and resignation services, ensuring full legal compliance every step of the way.

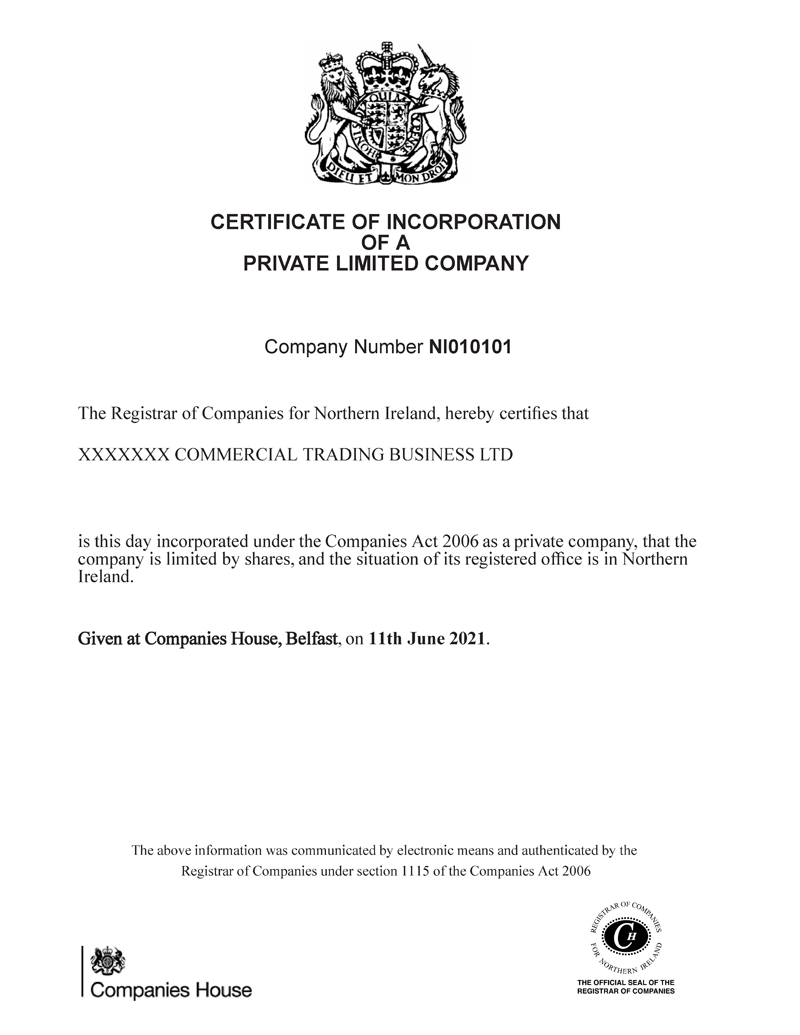

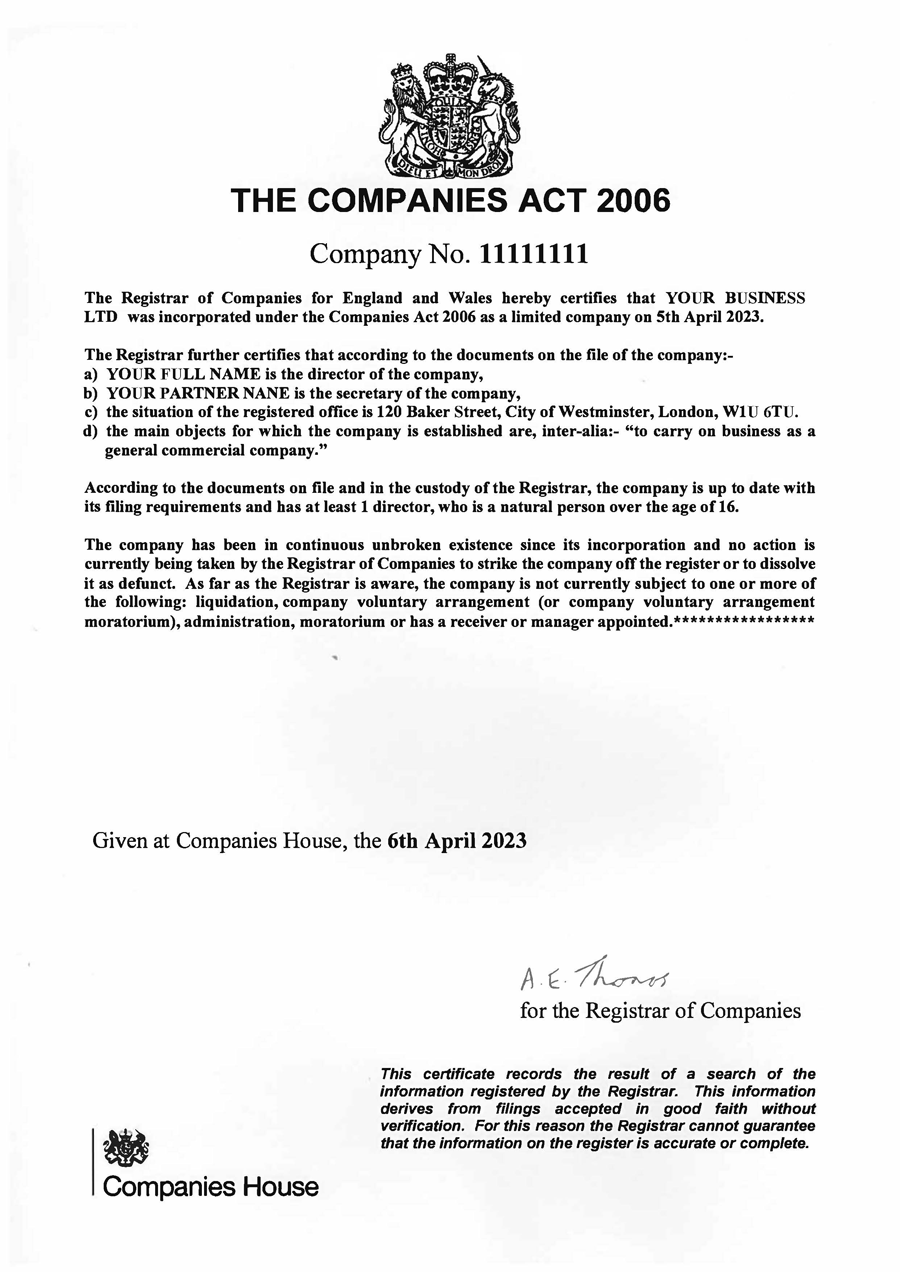

- Ensure your company remains compliant by understanding the essential documents required to appoint or resign a director; don't risk non-compliance!

- Simplify your business setup with our service; we handle all Companies House forms and paperwork, ensuring your company records are accurate and compliant.

- We offer an expert service for clients who wish to resign or appoint directors, including the filing of the Companies House forms and all other documents.

- Coddan simplifies the process of appointing or resigning directors, ensuring full compliance with UK company law; let us manage your administrative tasks efficiently.

- Expert services for director appointments, director resignations, and changes assistance, ensure legal compliance and pain-free transitions with Coddan.

- We offer a flat-fee service which handles the entire director appointment and resignation process, including the quick and compliant Companies House filings.

- Experience hassle-free director changes with our exceptional service; we take care of all Companies House filings and necessary documentation for you!

- Experience a seamless director appointment and resignation process; our flat-fee service guarantees quick and compliant Companies House filings.

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk