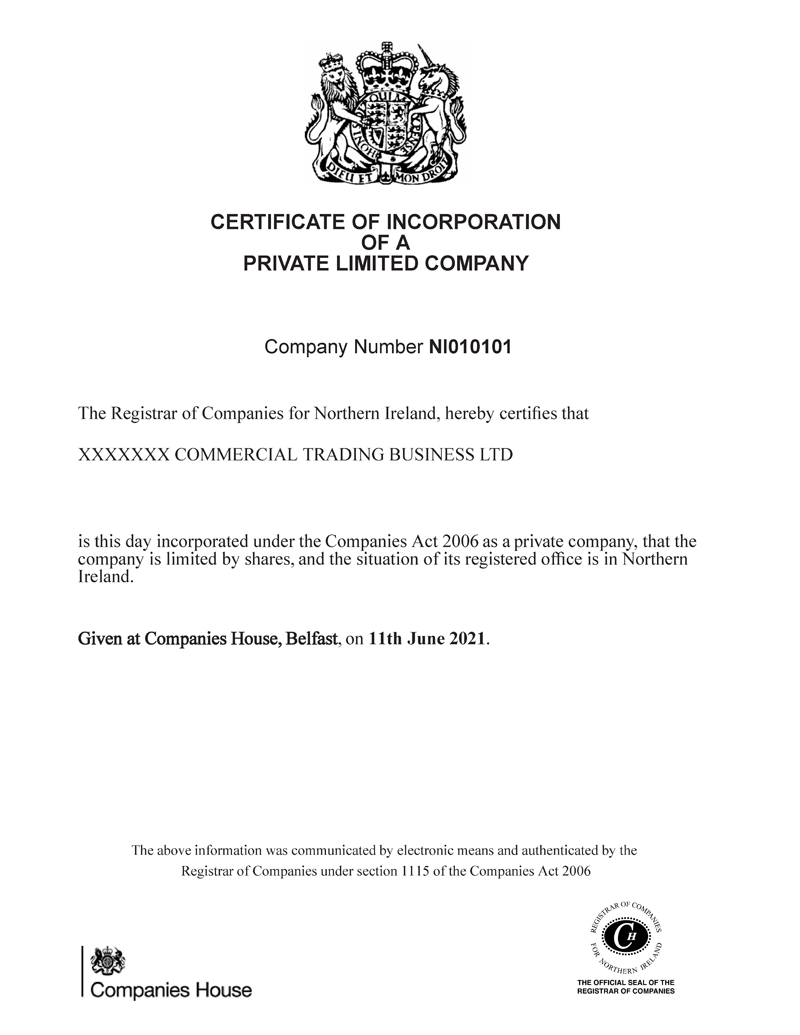

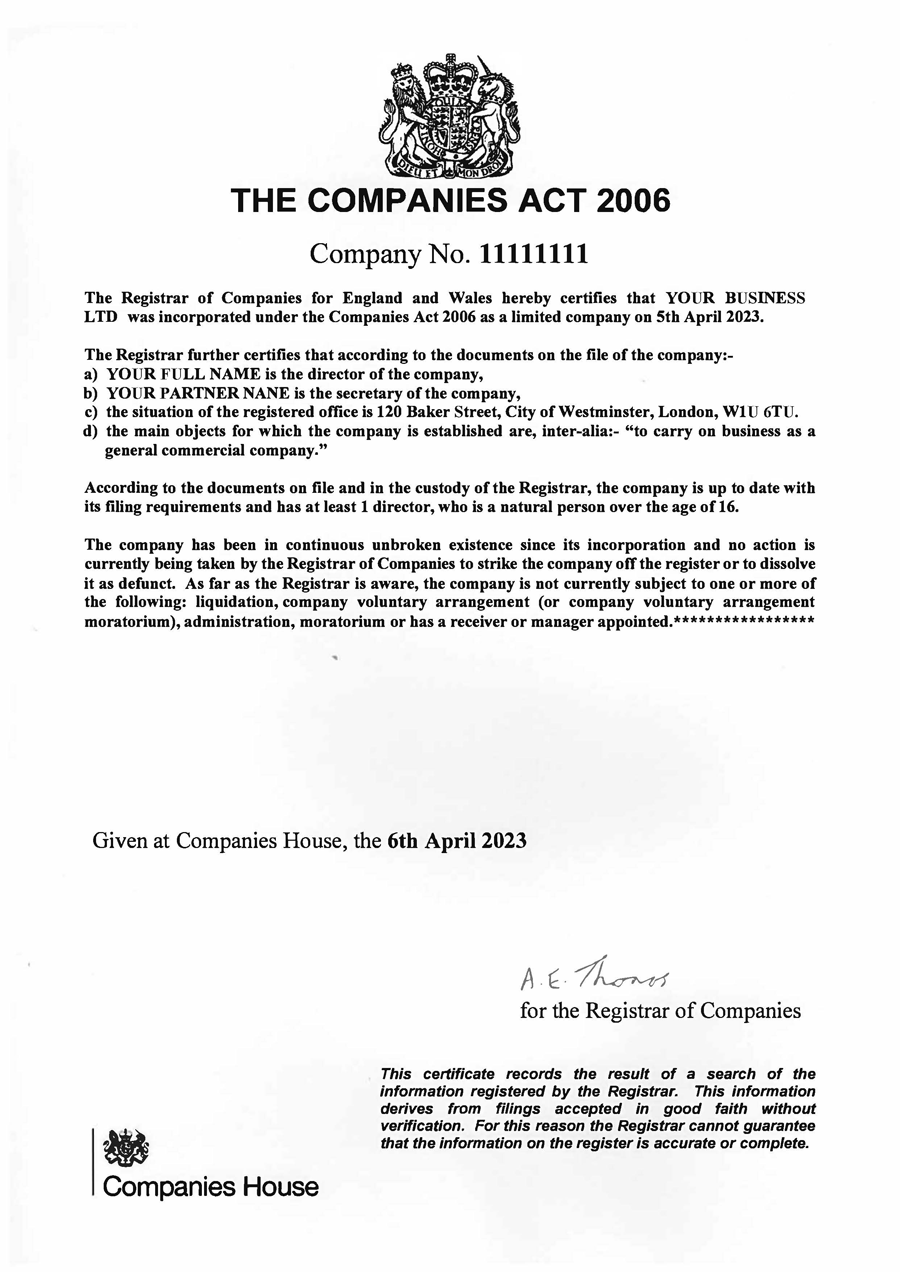

Incorporate your business with expert support.

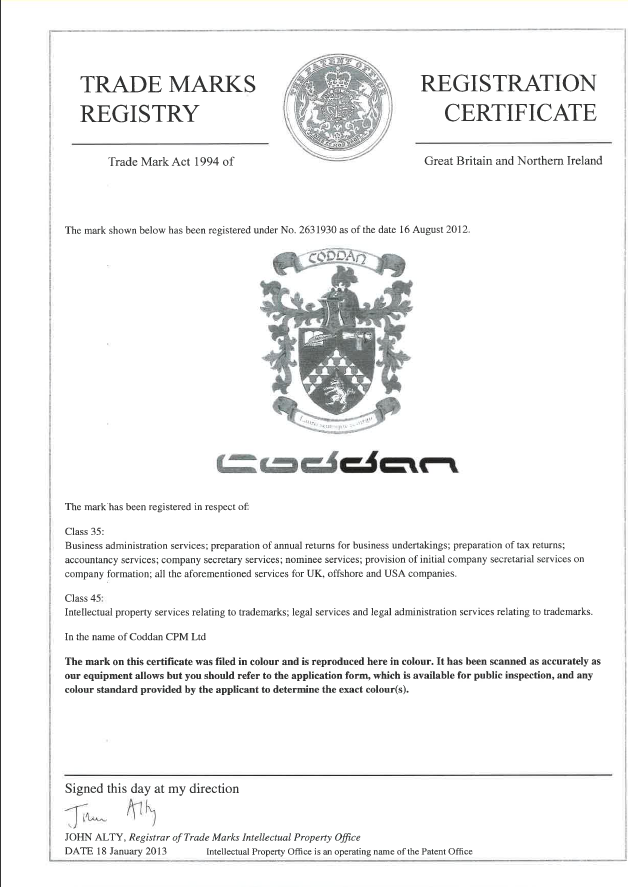

Get expert support for company formation and compliance, and professional assistance with legal and administrative aspects of starting a business.

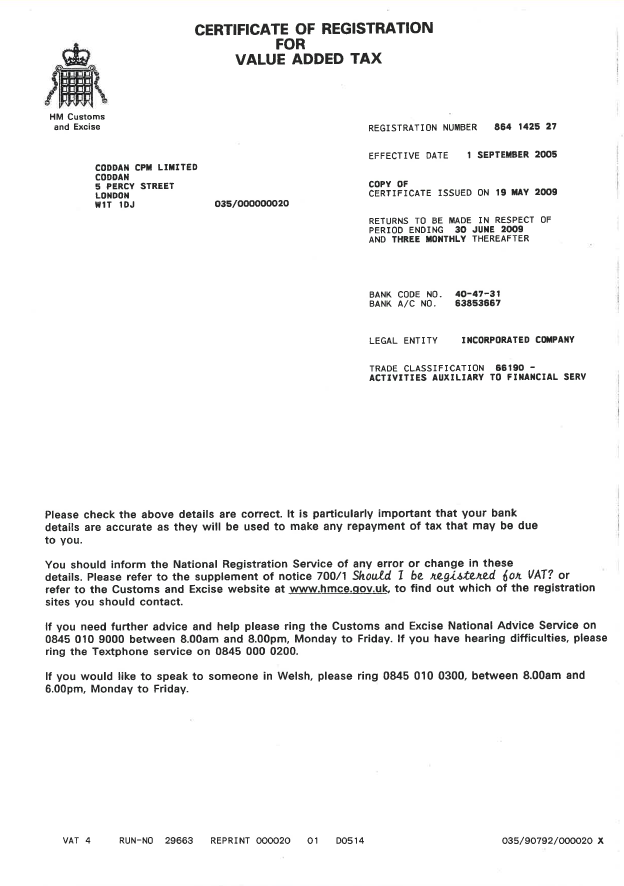

Coddan CPM, as your trusted ACSP provider, offers professional business services, low-cost LTD formation and expert support to make starting a business easier.

- Get expert support for setting up a company, enjoy professional guidance on legal, corporate, and administrative tasks to ensure a correct and compliant start-up.

- Get reliable expert advice on the most suitable legal structure and ensuring the company is correctly set up and registered with the necessary authorities.

- Expert support can make a significant difference, helping entrepreneurs navigate the complexities of company formation and ongoing compliance.

- Expert support for a foreign resident setting up a company by a service provider that handles the complex and technical steps of company formation.

- End-to-end incorporation support for foreign entrepreneurs, we provide expert support throughout the entire company formation process in the United Kingdom.

- With expert support in managing paperwork, securing registered agent services, and providing business registered office address and opening bank accounts.

- Unlimited access to our expert support team for ongoing business questions, compliance guidance, and assistance throughout your company's lifetime.

- Use comprehensive professional sassistance designed to navigate the legal, financial, and logistical complexities of incorporating a business in the U.K.

- Coddan CPM provides top-class business incorporation and ongoing support, including bookkeeping, payroll needs, and managing multi-currency operations.

- With Coddan CPM, Non-UK Residents (NRIs) can easily register a UK Ltd Company from anywhere in the world—no travel or physical document submission required!

9.30 am – 6.00 pm GMT

9.30 am – 6.00 pm GMT Monday-Friday

Monday-Friday info@coddan.co.uk

info@coddan.co.uk